1. Context

Non-communicable diseases (NCDs), or chronic diseases, represent a critical global health challenge, stemming from genetic, physiological, environmental, and behavioral factors (1-4). They are responsible for an alarming 71% of global deaths, with 40% directly attributed to dietary factors (5). The World Health Organization (WHO) has emphasized the urgency of combating NCDs as part of the 2030 Sustainable Development Goals, which include reducing NCD-related deaths by one-third by 2030 (6).

Sugar-sweetened beverages (SSBs) are a significant contributor to these chronic diseases, further intensifying the need for action (7). Excessive consumption of SSBs is strongly associated with increased rates of overweight and obesity and is linked to a heightened risk of hypertension, diabetes, cardiovascular disease (8-10), and certain types of cancer (11-14).

Sugar-sweetened beverages are non-alcoholic beverages that contain added sugars or caloric sweeteners, typically providing over 25 calories per 8 fluid ounces (15). Examples include carbonated drinks, sweetened milk, sweetened teas and coffees, sports drinks, energy drinks, fruit-flavored drinks, sweetened fruit juices, vitamin water drinks, sodas, and other beverages with added sugar (16-18).

The WHO states that SSBs lack health benefits and are not essential to a diet (19). For instance, a single can of soda contains 40 grams of sugar, exceeding the WHO's recommendation that free sugars comprise less than 10% of daily energy intake (19). Low- and middle-income countries (LMICs) are witnessing a dietary shift toward high-fat and high-sugar products, contributing to increased rates of NCDs (20, 21).

Statistics show that 5% of deaths related to SSBs occurred in low-income countries, 70.9% in middle-income countries (MICs), and 24.1% in high-income countries (22). As NCD prevalence rises, policies such as SSB taxation are gaining traction as effective interventions. By increasing prices, such taxes can reduce SSB consumption and promote healthier choices. This approach also addresses the societal costs of overconsumption while generating public benefits.

The WHO identifies two types of taxes: Direct (on income) and indirect (on goods/services). Excise taxes, a form of indirect taxation, are particularly relevant for achieving health objectives (23, 24).

Utilizing economic principles, such as taxing harmful goods (25-33), can effectively control risk factors by increasing prices and reducing demand. The primary economic rationale for imposing a tax on SSBs is to address overconsumption, as market prices often fail to account for the total societal cost of consumption. Taxes help internalize these unaccounted costs, reducing excessive SSBs consumption and benefiting society as a whole (34).

According to the WHO manual on SSBs taxation policies (19), there are two types of taxes: Direct and indirect. Direct taxes are levied on incomes, whereas indirect taxes apply to the production or consumption of goods and services. Within consumption taxes, there are sales taxes or value-added taxes, import duties, and excise taxes. Excise taxes, which are divided into three types—ad valorem, specific, and mixed excise—are particularly significant when considering health objectives.

A well-designed tax on SSBs can help reduce obesity and diabetes (35), both of which are significant risk factors for various cancers and cardiovascular diseases (36, 37). In addition to the health benefits linked to reduced SSBs consumption and an improved food environment, SSBs taxes have the potential to generate revenue. This revenue can support the general functioning of the state or be earmarked to fund subsidies for healthier food and beverage options. Moreover, such taxes can incentivize producers to reformulate their products, shifting resources away from taxed substances toward healthier alternatives (38).

Several systematic reviews (8, 39-45) have evaluated the impact of SSBs taxation on various health and economic outcomes. However, despite the abundance of these systematic reviews, there remains a need for an umbrella review to synthesize and critically appraise their findings. An umbrella review provides a comprehensive and systematic approach to consolidating evidence from multiple systematic reviews on a specific topic. By aggregating and evaluating findings from diverse sources, an umbrella review offers a unique opportunity to identify consistencies, discrepancies, and gaps in the existing literature (46).

This approach is particularly valuable in assessing SSBs taxation outcomes, as the rapidly evolving research landscape may produce conflicting findings or reveal emerging trends across different systematic reviews. While much of the existing evidence comes from high-income countries, the impacts of SSBs taxation in LMICs remain underexplored. Consumer responses to this policy may vary significantly in these income groups, highlighting the need for tailored research to understand its effectiveness in different socioeconomic contexts.

The present umbrella review synthesizes evidence from the growing number of systematic reviews in this field to offer actionable recommendations for policymakers, particularly in LMICs.

2. Objectives

This umbrella review aims to systematically evaluate and synthesize the existing evidence on the impacts of SSBs taxation in LMICs.

3. Methods

3.1. Search Details

This study was conducted in 2022. A search of seven databases (PubMed, Ovid, ProQuest, EBSCO, Web of Science, Scopus, and Embase) was completed in November 2022 using the following strategy: (Tax OR Taxation OR Subsidy OR Subsidies) AND (Sugar Sweetened Beverage OR SSB OR SSBs OR Soda OR Soft Drinks OR Energy Drinks OR Sport Drinks OR Fruit Drinks) AND (Demand OR Demand Elasticity OR Elasticity OR Price Elasticity) OR (Overweight OR Obesity OR Health Impact OR Diabetes OR Cardiovascular Diseases OR Non-Communicable Diseases OR NCDs). The search was restricted to English-language publications, including journal articles and conference papers, with no limitation on publication date.

3.2. Eligibility Criteria

The analysis includes systematic reviews and meta-analyses conducted in LMICs [note: For the study year, low-income economies are defined as those with a gross national income (GNI) per capita, calculated using the World Bank Atlas method, of $1,085 or less in 2021; lower middle-income economies are those with a GNI per capita between $1,08 and $4,255; upper middle-income economies are those with a GNI per capita between $4,256 and $13,205]. The studies are not restricted to specific populations or interventions, provided they demonstrate predefined outcomes. Published opinions or commentaries are excluded from the review.

3.3. Study Selection, Data Extraction, Quality Assessment, and Synthesis

Articles were independently reviewed by two authors to remove duplicates and identify systematic reviews that met the predefined criteria. Any discrepancies between the reviewers were resolved through discussion. Upon reaching consensus, the reviewers proceeded with data extraction using the Joanna Briggs Institute (JBI) data extraction form for systematic reviews and research syntheses (46).

The JBI extraction form includes detailed inquiries for each study, facilitating the identification and documentation of the most important and useful information. The extracted data were organized into a comparative table for further analysis. If the relevant data for predefined outcomes were not provided in the included systematic reviews, data from the original studies were reviewed. References were also checked separately to ensure comprehensive data coverage.

The quality of the included studies was assessed to ensure the reliability of the results. The methodological quality of each eligible study was evaluated using the JBI critical appraisal checklist for systematic reviews and research syntheses (46). This checklist consists of 11 queries addressing the review question, the quality of the appraisal tool, error minimization, and specific directives for further research.

The synthesis process involved a comprehensive review and descriptive analysis of existing research findings in relation to the following predefined questions (outcomes):

(1) How does the taxation of SSBs influence pricing dynamics?

(2) What is the impact of taxation on reducing the consumption (demand) of SSBs, particularly in terms of price elasticity?

(3) Does SSB taxation lead to a shift toward the consumption of substitute beverages, as indicated by cross-price elasticity?

(4) Is there a demonstrable link between implemented SSB taxation and a reduction in rates of overweight, diabetes, and NCDs?

(5) What potential unintended consequences may arise from the implementation of SSB taxation?

(6) What is the estimated range of tax revenue generated by SSB taxation, based on available evidence and projections?

4. Results

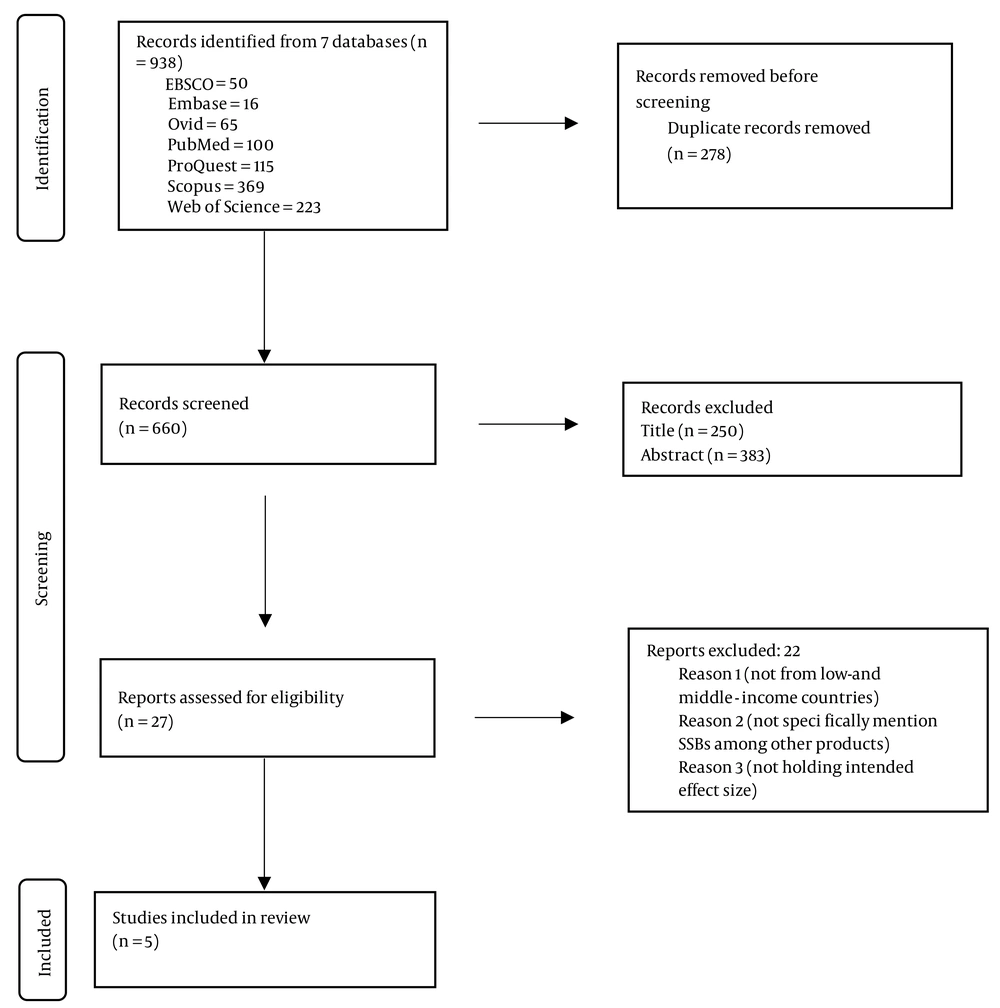

Across the seven database searches, 938 records were initially identified. After removing 278 duplicate entries, 660 unique records remained.

The title and abstract screening phase was then conducted, during which 633 records were excluded based on relevance. This step left 27 records for further consideration.

Subsequently, a full-text screening was performed. After a thorough review, 22 reports were excluded following the predefined criteria. Ultimately, five studies were included in the review.

Figure 1 presents the preferred reporting items for systematic reviews and meta-analyses (PRISMA) (47) flow diagram, which provides an overview of the selection process. The included studies originate from countries such as Brazil, Ecuador, Mexico, South Africa, and India.

4.1. Data Extraction

The extracted information includes the study's objectives, intervention, population, type of included studies, a summary of existing research syntheses relevant to the umbrella review's questions (outcomes), as well as the study's appraisal and synthesis method (46). The characteristics of the five studies included in this umbrella review are summarized in Table 1.

| Author/Year | Objective | Types of Studies | Outcome | Appraisal Rating/Tool | Findings/Effect Size | Method of Analysis | Intervention | Population | Heterogeneity |

|---|---|---|---|---|---|---|---|---|---|

| Vellakkal et al. (2022) (48) | Investigating whether public policies targeting unhealthy products could reduce cardiovascular diseases. | No restriction was imposed on the study designs and country settings. | BMI; obesity; diabetes (type 2 diabetes) stroke CHD; MI | JBI critical appraisal Tools studies are not rated. | Studies highlighted that the small magnitude of tax would not produce any meaningful difference in consumption behavior. Excise tax was more effective as compared to sales tax because the latter is not incorporated into the shelf price. | Qualitative synthesis | 1- Peso-perlitre increase in SSBs tax. 20% increase in SSBs excise tax. 20% increase in SSBs tax. 10 % increase in SSBs excise tax | Diverse population groups, adults aged +15, +20, 35 - 94 years and General population | Heterogeneity in both the study designs and the measures of intervention |

| Andreyeva et al. (2022) (5) | Associations of implemented SSBs taxes with prices, consumption, diet, body weight, product changes, unintended consequences, health, and pregnancy outcomes | Randomized trials, interrupted time series designs, controlled and uncontrolled before and after studies, quasi-experimental designs, cross-sectional analyses using propensity score matching, difference-in-differences methods and fixed-effect analysis, longitudinal analyses using fixed effects, and ecological analysis | Tax pass-through rate for prices, percentage reduction in SSBs demand, and price elasticity of demand | Consumption: Low quality majority of price and sales evaluations: High quality. BMI and diet evaluations: Medium quality (author-developed tool informed by the Cochrane ROBINS-I risk of bias tool for nonrandomized studies of interventions.) | Significant increase in prices of taxed beverages. Overall tax pass-through: 82% Meta-analyzed estimate for price elasticity for SSBs sales was -1.59. Across all studies and tax policies, significant reduction in SSBs sales of 15%. Consumption of taxed beverages: PE -3.78. no significant change in the consumption of untaxed beverages. (For each article, 1 main effect size per outcome was selected, estimated relative changes were extracted.) | Meta-analysis of 62 studies. Narrative synthesis of all studies for outcomes with few available studies or high heterogeneity across measures | Single-tier volume-based excise tax. Tiered volume-based excise tax 1 peso per liter excise tax (SSBs). 0.021 ZAR (~$0.0015) per g sugar > 4 g/100 mL excise tax (SSBs) | The review assessed the general population of children and adults (ages > 18 years) across all countries and setting. | High heterogeneity of results |

| Nakhimovsky et al. (2016) (49) | To assess effectiveness of SSBs taxing in LMICs | Modeling studies, non-experimental, quasi-experimental, or experimental | Changes in consumption of other foods and beverages. change in obesity and overweight (BMI, overweight and obesity prevalence) | Tool: Quality checklist for food and beverage taxes and subsidies studies in a previous systematic review. quasi-experimental studies ranked and Highest and the non-experimental studies and modeling studies ranked lowest. | Sufficient tax rate lead to obesity reduction. Tax can be complemented to other obesity prevention measures. lower socio-economic groups or more sensitive to price changes. Taxation tend to be regressive effect size: Own-Price Elasticities of SSBs and Change in kJ PPPD Given a 10%, Price Increase, SSBs own-PE, cross-PE of demand for SSBs). | Qualitative synthesis | Excise tax | Mexico individual samples: (19,512 and 27,994) households: (6,253 and 25,805) and throughout 46 cities Peru: Women 19 - 49 years old South Africa: Full population. India: Ranged from 100,855 to full population households Ecuador: 39,434 households. Brazil: 48,470 households | Heterogeneity in target products, methods for estimating consumption, study designs, and other characteristics |

| Miracolo et al. (2021) (50) | Impact of sin taxes on goods that are considered to be harmful from a public health perspective in Latin American countries. | All types of Peer-reviewed and grey literature | Reduction in harmful goods consumption, revenue generation health outcomes | Tool: ROBINS-I 28 of 34 studies reported at least a medium/unclear or high risk of bias. Most of the medium/high risk of bias were related to the outcome measurement and deviation from intended intervention (9 studies: High risk 2 studies: Medium/unclear). | Household purchases of non-essential energy-dense foods declined. SSBs tax led to a decrease of 7.3% in per capita sales of SSBs All the socioeconomic groups reducing their purchases levels of taxed beverages. SSBs tax led to a decrease in taxed beverages purchases of 5.5%. A significant reduction in the number of people affected by diabetes, suffering a stroke or a heart attack and an overall reduction in deaths. A 20% reduction in SSB consumption saved 1.9 billion dollars. 1% increase in SSBs price led to a 0.85% reduction of SSB calories consumed | Qualitative synthesis | Sin taxes. Mexican peso per liter. 8% ad valorem tax | Mexico individuals: (29/2,338 /6,650) Mexico household: (6,089/6,248/6,645/ 6,253) Brazil 48,470 households | Not mentioned |

| Itria et al. (2021) (51) | To evaluate the potential impact of sugar-sweetened beverage (SSBs) taxes on overweight and obesity prevalence in countries of different income classifications | Modelling, non-experimental, quasi-experimental or experimental studies | Overweight and obesity prevalence, change in body weight or BMI, SSBs consumption/purchase, energy intake | Critical appraisal tool reported quality was similar among studies. | SSBs tax can lead to a decrease in purchase and reduce overweight (for countries with higher price elasticity, the effect of an SSBs tax will be higher. The results of systematic review showed that an SSBs tax could be an effective fiscal policy to decrease the purchase and consumption of SSBs and reduce overweight/ obesity prevalence.) Mexico: 10 % taxation decrease consumption by 21·62 ml/person/d, 20 % taxation decrease consumption by 43·23 ml/person/d for 1peso/l tax Average reduction of 7·6 % in purchases is reported. South Africa: Reduction in energy intake of 36 kJ/d following 20 % excise tax India: Reduction of 0.94 % in SSBs consumption for each 1 % increase in SSBs price Substitution: 0·049 % increase in milk; 0.31 % increase in fruit juice; 0.13 increase in tea | Qualitative synthesis | 1- Peso/l tax (10 % taxation) and 2-peso/l tax (20 % taxation) 20 % Excise tax | Mexico: Households and adults aged ≥ 16 years South Africa: Youth and adults (≥ 15 years old) India: Adults (25 to 65 years old) | High heterogeneity was associated with methods of estimating outcomes |

Abbreviations: SSBs, sugar-sweetened beverages; JBI, Joanna Briggs Institute.

4.2. Quality of Included Studies

The quality assessment revealed that all five studies comprehensively addressed at least eight of the JBI appraisal questions. However, challenges arose during the assessment process for questions 6, 7, and 9. Question 6 examines whether the critical appraisal of each included study was conducted independently by two or more reviewers; question 7 evaluates whether any methods to minimize errors in data extraction were mentioned; question 9 assesses whether the likelihood of publication bias was considered.

These challenges are detailed in Table 2, which outlines the quality assessment results for each included study.

4.3. Study Outcomes (Questions)

Q1: How does the taxation of SSBs influence pricing dynamics?

Aurelio Miracolo et al. (50) found that a 1 peso per liter tax on SSBs in Mexico led to an 11% price increase for carbonated SSBs and approximately a 10% increase for non-carbonated ones in January 2014. Six studies confirmed a similar 10% price increase due to this tax.

Nakhimovsky et al. (49) reported a 20% price increase in India and South Africa following SSB taxation in 2014. Itria et al. corroborated these findings for India (51). In Mexico, the tax caused soda prices to rise by 12% within 15 months, exceeding the tax rate of 1 peso per liter. By early 2015, sugary soda prices had reached 1.4 pesos per liter, while other SSBs increased by only 0.6 pesos per liter, showing less sensitivity to the tax.

Studies also highlighted the greater responsiveness of lower socio-economic groups to price changes. Andreyeva et al. (5) estimated a price elasticity of demand for SSBs at -1.59, suggesting that demand decreased as prices increased. Additionally, they estimated that 82% of the tax was passed on to consumers, indicating an incomplete pass-through effect.

Q2: What is the impact of taxation on reducing the consumption (demand) of SSBs, particularly in terms of price elasticity?

The findings of the umbrella review consistently demonstrate that taxing of SSBs has a significant impact on reducing their consumption. The studies showed a consistent negative correlation between price and SSBs consumption, indicating that SSBs products are sensitive to price changes and that SSBs taxes are an effective policy for reducing their demand. Various measures, including price elasticities, kilojoules per person per day (kJ PPPD), and daily milliliter reductions per person (mL/person/d), were used to measure the impact of taxing on SSBs consumption. The adjusted kJ PPPD estimates changes in the consumption of SSBs products given a 10% change in SSBs prices, while price elasticity evaluates the change in consumption over a percentage change in price.

Aurelio Miracolo et al. (50) reviewed the effects of sin taxes on SSBs in Latin America, focusing on 12 studies. Six of these looked specifically at Mexico, where a 1 peso/l tax led to a 5.5% to 9.7% drop in SSBs purchases over two years, especially among low-income groups. Another study noted an 8% ad valorem tax, showing a 4% decline in 2014 and 14.2% in 2015 for taxed beverages. Notably, while some consumers with unhealthy habits cut back overall, those with healthier habits didn't change much. Awareness of the tax varied; one study found many people didn't realize it was affecting their choices. In Brazil, a 1% Price Increase in SSBs resulted in a 0.85% decrease in calorie intake from these drinks. Sharon S. Nakhimovsky's review on SSB taxation in MICs, including Brazil and Mexico, highlighted a clear link between SSB Prices and consumption. A 10% price hike could reduce daily energy intake by 5 to 39 kJ per person, with lower-income individuals being more responsive to price changes than others (49).

Alexander Itria et al.'s review (51) focused on theoretical models in upper- MICs, finding that SSB taxation led to decreased purchases and energy intake. Taxes of 10% to 20% resulted in reductions of 21.62 to 43.23 mL/person/day. In South Africa, a 20% tax reduced energy intake by about 36 kJ daily, while Mexico's 1 peso per liter tax led to a 6.1% decrease in SSBs purchases in the first year. Price elasticity data from Mexico and India suggested that taxing SSBs could lower consumption, and Brazil's analysis confirmed the impact of pricing on SSBs consumption. Andreyeva et al. (5) also found that in Mexico, low-income households showed greater reductions in SSB sales post-tax, indicating that lower socioeconomic groups are more responsive to price changes compared to others in MICs.

Q3: Will SSBs taxation result in a shift towards the consumption of substitute beverages, as indicated by cross-price elasticity?

Taxes on SSBs generally reduce demand and consumption, often leading to increased sales of alternative drinks like water, tea, coffee, and milk. The effectiveness of these taxes in combating obesity may be limited if similar-calorie substitutes are available. Water is the most preferred alternative due to its affordability. Cross-price elasticity helps assess the impact of SSB taxes by measuring demand changes for untaxed alternatives when SSB prices rise.

Itria et al. (51) found that only two studies from MICs examined cross-price elasticities related to SSB taxes, showing increased consumption of bottled water, milk, fruit juice, and tea post-tax. For example, a 20% tax in India led to a 0.049% rise in milk consumption and a 0.31% increase in fruit juice consumption. Nakhiovsky et al. (49) also noted that milk is likely a substitute for SSBs, while snacks and candy may complement them. Findings on juice were mixed (49); some studies identified it as a substitute for SSBs, while others indicated it was a complement. Evidence suggests that low-income households showed greater reductions in SSB purchases without significant offsets from other caloric beverages, potentially leading to an overall decrease in caloric intake.

Studies from Mexico indicated positive cross-price elasticities for milk and water, while sweet drinks and juice were seen as complements to soda. Overall, the decrease in SSB consumption was greater than any increase in milk consumption following price hikes.

Q4: Is there a demonstrable link between implemented SSBS taxes and a reduction in rates of overweight, diabetes, and NCDs?

A study by Miracolo et al. (50) found that 10% and 20% taxes on sugary drinks over 10 years significantly reduced diabetes, strokes, heart attacks, and overall mortality in Mexico. This research highlighted the positive effects of sin taxes on health in Latin America. Simulations indicated a notable decrease in health issues, particularly among those aged 35 - 49.

According to a review by Vellakkal et al. (48), similar taxes could prevent thousands of cases of diabetes and heart-related issues in Mexico, India, and South Africa. These fiscal policies may help combat diabetes and cardiovascular disease epidemics globally. Nakhimosky et al.'s (49) review suggested that taxing SSBs could benefit MICs struggling with obesity. A 10% price drop in SSBs was linked to increased obesity prevalence, while a 20% tax could reduce overweight and diabetes rates, with specific projections for India and South Africa.

Itria et al. (51) reviewed several studies on the potential impact of a tax on SSBs in reducing the prevalence of overweight and obesity. The study suggests that a 20% tax on SSBs would have a greater effect than a 10% tax, with reductions in obesity prevalence reported in upper-middle-income. For example, in Mexico, a 10% tax was expected to lead to a 0.31 kg/m² decrease in Body Mass Index (BMI) per person and a 2.54% decrease in obesity prevalence. In South Africa, a 20% tax was projected to result in a 3.8% decrease in obesity prevalence in men and a 2.4% decrease in women. Comparable outcomes were observed in India, with an anticipated reduction in the prevalence of overweight by 1.6% and obesity prevalence by 5.9%, especially among males, individuals in the lower-income bracket, and rural populations.

However, no studies were identified on the potential impact of SSBs taxes on pregnancy, undernutrition, and diet-related NCDs.

Q5: What potential unintended consequences may arise from the implementation of SSBs taxation?

According to Nakhimovsky et al.'s (49) review of evidence, unintended consequences of SSBs taxation may include increased illicit trading, cross-border shopping, increased retailer revenue, and employment and unemployment effects. This study found that unintended consequences were mentioned in at least 15 articles among all the included studies, with most statements coming from high-income countries.

For example, studies on local US taxes pointed to a significant increase in cross-border shopping, and several studies showed a reduction in total grocery sales for some retailers. Additionally, a Mexico-based study found no change in manufacturing jobs and lower national unemployment rates. However, there is no evidence available for these outcomes in LMICs from the included studies. No study has reported the effect of taxing SSBs on the illicit trade of these products.

Q6: What is the estimated range for tax revenue generated by SSBs taxation, based on available evidence and projections?

Studies have reported an increase in revenue generation from the implementation of sin taxes in Latin America in Miracolo et al.'s review of evidence (50). According to their review, positive effects on revenue generation were found in 71% of included studies, suggesting that there may be additional scope for further tax increases.

One simulation study reported that a 10% reduction in SSBs consumption could result in a savings of 983 million international dollars over 9 years, while a 20% reduction could lead to a saving of 1.9 billion international dollars.

5. Discussion

The impact of post-tax price changes on SSBs is a well-researched aspect of taxation. There is compelling evidence indicating that taxes on SSBs result in higher prices for these taxed beverages. Studies have demonstrated that in non-competitive markets, the price increases can match or even surpass the tax rate. Moreover, even in competitive markets, price increases lower than the tax rate can still lead to a reduction in SSBs consumption. Additionally, it is suggested that SSBs Prices may remain elevated in the long term, even as new competitors enter the market.

The influence of taxes on SSBs on consumer demand is significant, as individuals are highly sensitive to price fluctuations. The effectiveness of these taxes in curbing calorie intake depends on the proportion of SSBs consumption relative to total energy intake, with higher consumption levels yielding a more significant potential impact. Moreover, in nations with greater price elasticity, the effects of SSBs taxes are anticipated to be more pronounced. Lower socioeconomic groups have shown a heightened responsiveness to price adjustments in SSBs compared to their higher socioeconomic counterparts. Our comprehensive review suggests that implementing an SSBs tax has the potential to be an effective fiscal policy measure in reducing SSBs consumption.

The imposition of a tax on SSBs has led to consumers shifting towards consuming other high-calorie drinks or foods, potentially offsetting the intended calorie decline. This substitution effect is highlighted in studies by various researchers. Understanding these findings is crucial in evaluating the effectiveness of SSBs taxation and its broader impact on beverage consumption. The increased consumption of substitutes can have varied health outcomes, and it may be necessary to include potential substitutes in the tax policy to achieve desired public health outcomes. Research suggests that higher taxes on SSBs may lead to reduced consumption of added sugars and lower rates of obesity, with potential positive impacts on health outcomes, particularly in MICs. However, more longitudinal data is needed to fully assess long-term benefits.

The impact of SSBs taxes varies between high-income and middle-income countries, with greater reductions in obesity prevalence observed in MICs. Additionally, SSBs taxes have been associated with the prevention of NCDs, such as cardiovascular diseases and certain types of cancer. Simulation models indicate that increased SSBs taxes could lead to substantial gains in life years by preventing disease onset and reducing mortality rates. The research on unintended consequences of SSBs taxes is limited, with only one review by Andreyeva et al. (5) addressing this topic. The review found evidence of unintended consequences in high-income countries, such as cross-border shopping and reduced revenue for local retailers due to local SSBs taxes in the United States. However, there is no evidence of negative effects on jobs in either low- or middle-income countries or high-income countries. Opponents argue that consumers may switch to untaxed but not necessarily healthier alternatives or shop in neighboring areas to avoid the tax, but evaluations suggest that well-designed taxes can minimize these issues and have an overall positive impact. Miracolo et al. (50) suggests that broader considerations, such as law enforcement to counter illicit trade effects, should shape discussions around the introduction of sin taxes, as it can significantly influence the effectiveness of such policies. By incorporating measures to combat illicit trade, policymakers can better understand and mitigate the potential consequences of taxing SSBs, ensuring that the intended public health and economic objectives are achieved.

Results of this review support the use of excise taxes to generate additional revenue sustainably, particularly for products deemed potentially harmful. While tax increases on harmful products can boost total revenue, it's noted that with tobacco and alcohol, increased taxation may not always lead to expected revenue due to changes in consumption levels or expansion of the illicit market. To address potential burden on the poor, MICs may consider allocating some tax revenue to support health promotion for marginalized populations.

Miracolo et al. (50) emphasize that the effectiveness of sin taxes in financing healthcare depends on factors such as the type of tax, consumer response to price increases, income levels, disease burden, earmarking of taxes, and political consensus on public expenditure decisions. These factors also influence the feasibility of introducing additional taxes. The choice of tax mechanism is a crucial determinant of its efficacy, and research indicates that excise taxes are particularly impactful. Vellakkal et al.'s (48) findings unequivocally demonstrate that the imposition of an excise tax on SSBs would effectively achieve the dual objectives of reducing consumption and generating revenue, with a potential allocation of funds to support public health initiatives. Furthermore, Miracolo et al.'s (50) investigation underscores the ongoing discourse regarding the selection between a 'per unit' and 'ad valorem' tax, highlighting the feasibility of per-unit taxes for implementation in LMICs due to regulatory and administrative constraints. However, it also emphasizes the necessity for frequent revisions to sustain effectiveness, as manufacturers may seek to mitigate the tax burden and consumers may alter their consumption patterns in response. Conversely, an ad valorem tax presents advantages in terms of adjusting to inflationary changes and its visibility, as it is directly payable to the authorities (50). This discourse underscores the intricacy of implementing excise taxes and emphasizes the imperative consideration of various factors to ensure their effectiveness in revenue generation and influencing consumer behavior.

Taxes on unhealthy foods and beverages may initially place a heavier financial burden on low-income households, as they tend to spend more on these products. However, low-income consumers are also the most likely to cut back their spending on these items in response to such taxes. Over time, the health and economic advantages of these taxes are anticipated to be more significant for low-income individuals, who bear a disproportionate burden of obesity and diet-related diseases. Redirecting tax revenue to programs that benefit low-income communities can further amplify the positive impact on equity.

5.1. Conclusions

Based on the discussion provided, the conclusion regarding the impact of SSBs taxation in low and MICs can be summarized as follows:

(1) Impact on prices: Taxation on SSBs leads to increased prices of these beverages. The degree of price increase may vary depending on market competitiveness, but generally, the tax is at least partially passed on to the consumer. This price elevation is expected to persist in the long term.

(2) Reduction in SSBs consumption: Higher prices due to SSBs taxes have been shown to significantly reduce the demand for SSBs. The reduction in consumption is more pronounced in non-competitive markets, countries with higher price elasticity, and among lower socioeconomic groups.

(3) Substitution effects: While SSBs taxation reduces consumption of taxed beverages, it may lead to increased consumption of other high-calorie foods or beverages, which could offset the intended calorie reduction. Substitution effects vary and can lead to both positive and negative health outcomes depending on the alternative chosen.

(4) Health outcomes: Although more longitudinal research is needed, short-term studies suggest that SSBs taxes may decrease the intake of added sugars from these beverages, leading to reductions in BMI, obesity rates, and potentially, the prevalence of NCDs such as cardiovascular diseases and certain types of cancer.

(5) Unintended consequences: Unintended consequences of SSBs taxes, such as cross-border shopping and reduced revenue for local retailers, have been observed in high-income countries. However, the evidence regarding a negative impact on jobs is not clear, and there is a lack of evidence on the effect of taxing SSBs on illicit trade in low and MICs. To achieve a better impact, addressing illicit trading should be considered in discussions around the introduction of sin taxes. Further research is needed in these countries to assess the unintended consequences of SSBs taxation. Moreover, well-designed taxes can minimize these unintended consequences.

(6) Tax revenue: Sugar-sweetened beverages taxes have been shown to generate additional revenue, which can be significant. The extent of revenue generation varies depending on consumer behavior (which itself is influenced by tax share and price elasticity), the possibility of illicit trade expansion, and the specific economic context. Revenue from these taxes can potentially be allocated to public health initiatives, especially in MICs.

(7) Type of tax and effectiveness: The effectiveness of SSB taxes is significantly influenced by the type of tax implemented. Excise taxes have been particularly noted for their effectiveness in reducing SSBs consumption and generating revenue. These taxes can be structured as 'per unit' or 'ad valorem', with 'per unit' taxes being more suited for LMICs due to ease of implementation and administration, while 'ad valorem' taxes have the advantage of adjusting to inflation and being directly payable to authorities.

(8) Impact on low-income households: Although taxes on SSBs might impose an initial financial burden on low-income households, these consumers are more likely to reduce their consumption in response to the tax. This behavior change can lead to significant long-term health and economic benefits for these groups, who are disproportionately affected by obesity and diet-related diseases.

(9) Equity considerations: To mitigate the regressive nature of SSBs taxes, the revenue generated can be strategically used to support programs that benefit low-income communities, enhancing the equity and public health impact of the policy.

(10) Fiscal and political considerations: The success of SSBs taxes in financing healthcare and achieving public health goals depends on multiple factors, including the type of tax, consumer price responsiveness, income levels, disease burden, and political consensus on public spending.

In essence, SSBs taxes appear to be an effective policy tool for reducing SSBs consumption and potentially improving public health outcomes. However, their effectiveness is influenced by market dynamics, consumer behavior, and the broader economic and political environment. To maximize health benefits and minimize unintended consequences, SSBs taxation policies should be carefully designed and accompanied by complementary measures such as public education, bans on advertising and sponsorship for SSBs, and monitoring of substitution effects.