1. Background

From the perspective of 1404, Iran's insurance industry envisions itself as an economically just, sustainable, and reliable sector deeply integrated with society. Its mission is to ensure the natural progression of individuals' lives and the smooth functioning of economic, agricultural, industrial, and service activities (1).

One of the primary objectives of healthcare systems is to offer financial protection to patients against catastrophic healthcare expenses (CHE) (2). Insurance serves as a mechanism for accessing various medical services, including inpatient and paraclinical services (3). However, in developing countries, community health services are predominantly financed through out-of-pocket (OOP) payments (2). In Iran, basic medical insurances (e.g., social security and health insurance) cover essential medical expenses for the population. Nevertheless, challenges related to the quality and extent of services covered by these insurances (level of insurance coverage) have arisen, leading to inefficiencies, increased OOP spending, and the emergence of CHE (4).

The rapid and profound changes, along with associated crises, in today's world present numerous challenges for various organizations and institutions. In such circumstances, managers require new tools and methods to maintain their competitive edge and effectively oversee multifaceted and complex activities. They need instruments that empower them to respond appropriately to unforeseen and sudden events (5). The concept of competition is a common thread across all industries and services (6). Given the heightened competitive environment, both countries and companies recognize that making informed decisions and devising effective competitive strategies demands more than limited internal resources or random external information. Accessing accurate, impactful, and up-to-date information about their operational environment is a potent asset, holding significance at the national and corporate levels. Consequently, organizations strive to acquire the best sources of information regarding their business environment and activities, utilizing them effectively in their strategic planning (7).

The root cause of this issue can be attributed to the ever-increasing cost of healthcare and the various methods of delivering medical services. Consequently, the presence of supplementary medical insurance becomes essential to bridge the service and commitment gap within the basic medical insurance sector (8).

On the other hand, the growth of the insurance industry relies on various factors, including overall economic expansion in the region, population growth, heightened awareness of the necessity of insurance, and a supportive legal framework. This framework is evaluated through various indicators such as insurance premiums, insurance penetration, and more (9).

Resource allocation prioritization, predominantly based on financial criteria and sales calculations, has consistently posed the most significant challenge in the insurance sector. This has led to unhealthy competition among insurance companies, including different branches of the same company (10).

Simultaneously, there are issues causing dissatisfaction among policyholders, such as the ambiguous distinction between the responsibilities of the primary (basic) and secondary (supplementary treatment) insurers, limited service coverage, inadequate comprehensive insurance coverage encompassing a wide array of diagnostic and treatment procedures, unavailability of insurance services at contracted healthcare facilities, lack of familiarity with supplementary medical insurance rules and regulations, insufficient awareness and a suitable culture among customers regarding the purchase of such insurance policies, and rising operational costs for insurance companies (11).

Cheshin et al. posits that competition leads to the dismantling of monopolies, resulting in reduced prices. Therefore, he advocates for companies to operate within competitive environments as a means to curtail costs and enhance efficiency (12).

Hence, this research poses the questions: What are the effective factors in ensuring policyholder satisfaction, and how should these factors be prioritized? We identified and examined the potential of this concept in reducing costs for insurance companies, increasing insurance penetration rates in society, and enhancing supplementary medical insurance services.

2. Objectives

The primary objectives of this study were to identify customer satisfaction indicators related to supplementary health insurance, prioritize these concepts, and foster a comprehensive understanding of customer satisfaction. These efforts aimed to establish a mutually beneficial relationship between insurance companies and policyholders.

3. Methods

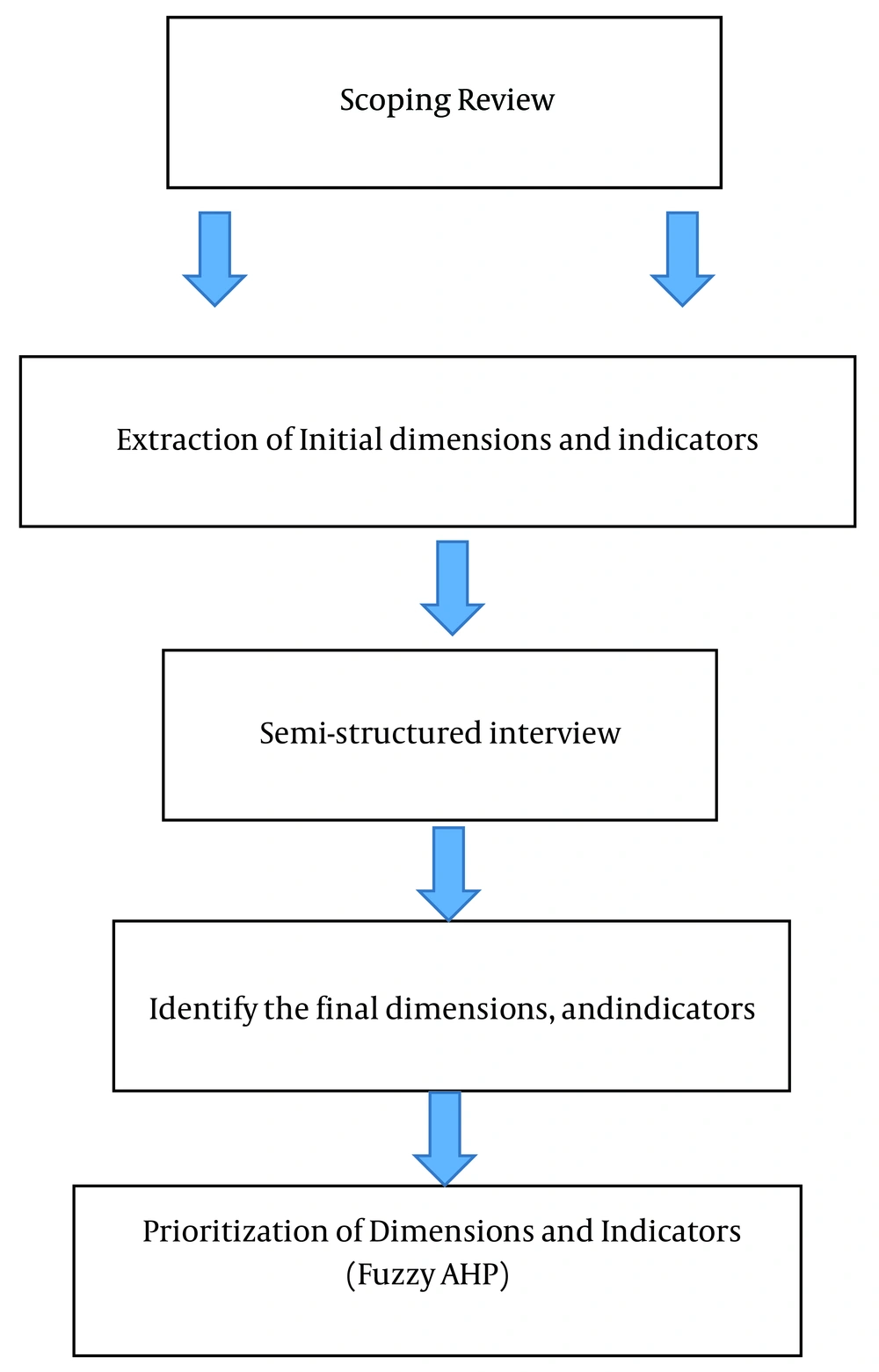

This study employed an exploratory mixed-method (qualitative-quantitative) approach involving 20 participants, including university faculty members, managers, and insurance experts from Khuzestan province. Participants were selected through purposeful sampling. Data collection encompassed a mixed-method approach, combining a scoping review and the fuzzy Delphi method (Figure 1). The indicators derived from these methods (scoping review and fuzzy Delphi) were subsequently prioritized using the fuzzy analytic hierarchy process (AHP) method. The research tool's validity was ascertained through external observer assessments (colleagues), while the coefficient of agreement method was employed to establish the tool's reliability (Figure 2).

3.1. Identification of Dimensions and Indicators of Customer Satisfaction

To identify dimensions and indicators of customer satisfaction, we initially conducted a research topic investigation by convening a meeting with experts, primarily those well-versed in the fields of insurance and medical services. Subsequently, we formulated the primary research question, which focused on factors related to customer satisfaction with supplementary medical insurance.

3.1.1. Search Strategy and Selection Criteria

We conducted a comprehensive literature search in Scopus and Web of Science from 2015 to 2020. Additionally, we explored Google Scholar, Microsoft Academic, and Dimensions for supplementary studies. The literature search employed specific search terms, including "customer satisfaction" AND ("per capita fee rate*" AND ("ceiling of insurance obligations*" OR "waiting period*" OR "Handling complaints*" OR "Notices*" OR "Franchise*" OR ".*Discrimination in providing services" OR ".*Respectful treatment." OR ".*Reasonableness of documents." OR ".*online services"). We included articles that met the following criteria: (1) Original research articles published in peer-reviewed journals, (2) assessing business management, social sciences, or interdisciplinary topics, (3) being indexed in Scopus or WoS databases, (4) published between 2015 and 2020, (5) available in English or Persian, and (6) directly or indirectly addressing the issue of customer satisfaction.

3.1.2. Quality Assessment

To ensure the quality of our findings, we exclusively included original articles from peer-reviewed journals. Such articles undergo rigorous academic scrutiny, making them reliable sources for systematic literature reviews. We meticulously reviewed all articles to eliminate duplicates and irrelevant studies. Abstracts were carefully examined, and in cases of unclear abstracts, the entire paper was reviewed to determine its relevance and inclusion in the review process. This step ensured a refined selection of articles.

3.2. Fuzzy Delphi Technique Algorithm for Screening

The Fuzzy Delphi technique with a fuzzy approach was employed to assess the importance of criteria and screen key criteria. The fuzzy Delphi technique algorithm encompasses the following steps:

- Identification of a suitable spectrum for fuzzifying linguistic expressions.

- Fuzzy aggregation of fuzzified values.

- Defuzzification.

- Selection of the threshold and screening criteria.

3.2.1. Step 1: Collecting and Fuzzifying Expert Opinions

In the fuzzy Delphi method algorithm for screening, the first step is to develop an appropriate fuzzy spectrum for fuzzifying the linguistic expressions provided by respondents. In this study, we used established methods or common fuzzy spectra for this purpose (Table 1).

| Linguistic Expressions | Fuzzy Number |

|---|---|

| Very important | (0.75, 1, 1) |

| Important | (0.5, 0.75, 1) |

| Moderately important | (0.25, 0.5, 0.75) |

| Unimportant | (0, 0.25, 0.5) |

| Very unimportant | (0, 0, 0.25) |

Triangular Fuzzy Numbers for Five-Point Scale

3.2.2. Step 2: Fuzzy Aggregation of Opinions

Once an appropriate fuzzy spectrum was selected or developed, experts' opinions were collected and fuzzified. In the second step, these opinions were aggregated. Various methods exist for the fuzzy aggregation of experts' opinions. If any expert's opinion was expressed as a triangular fuzzy number (l, m, u), the simplest method for calculating the fuzzy average was applied to experts' opinions.

3.2.3. Step 3: Defuzzification

After aggregating the fuzzy opinions of experts, the values needed to be defuzzified. The aggregation of triangular and trapezoidal fuzzy numbers can be summarized into a crisp value, which represents the best average. If F = (L, M, U), then the defuzzified value (F) is calculated as F = (L + M + U)/3.

3.3. Prioritization of Dimensions and Indicators of Customer Satisfaction (Fuzzy AHP)

Since the criteria for evaluating customer satisfaction have varying significance and meanings, it is inappropriate to assume that each evaluation criterion holds equal importance. Several methods can be employed to determine weights, such as the eigenvector method, weighted least square method, entropy method, analytic hierarchy process (AHP), and linear programming techniques for multidimensional analysis of preference (LINMAP). The choice of method depends on the nature of the problem. Evaluating customer satisfaction is a complex and extensive task, demanding a comprehensive and adaptable approach.

The analytic hierarchy process, developed by Saaty (13), is a valuable decision analysis tool for addressing multiple criteria decision problems. However, during the application process of the AHP method, it is often more intuitive for evaluators to assess that "criterion A is much more important than criterion B" rather than assigning precise ratios, such as "the importance of principle A is seven times that of principle B." Therefore, Buckley extended Saaty's AHP to situations where evaluators can utilize fuzzy ratios instead of exact ratios when comparing two criteria, ultimately deriving fuzzy weights for criteria through the geometric mean method (14, 15).

In this study, we employed Buckley's method, known as FAHP, to incorporate fuzzy hierarchical analysis by allowing the use of fuzzy numbers for pairwise comparisons and determining fuzzy weights. In this section, we provided a brief overview of the concepts related to fuzzy hierarchical evaluation.

3.3.1. Fuzzy Numbers

Fuzzy numbers represent a fuzzy subset of real numbers, extending the concept of a confidence interval. The use of linguistic variables is prevalent, and the linguistic effect values for customer satisfaction alternatives identified in this study primarily serve to assess the linguistic ratings provided by the evaluators.

3.3.2. Linguistic Variables

According to Zadeh (16), conventional quantification struggles to reasonably express situations that are overtly complex or hard to define. Therefore, the concept of a linguistic variable becomes necessary in such situations. A linguistic variable is one whose values consist of words or sentences in a natural or artificial language. In this context, we employ this type of expression to compare eleven customer satisfaction evaluation criteria using five fundamental linguistic terms: "Extremely vital important," "intermediate value between 7 and 9," "very vital important," "intermediate value between 5 and 7," "essentially important," "intermediate value between 3 and 5," "moderately important," "intermediate value between 1 and 3," and "equally important." These terms are mapped to a fuzzy five-level scale (17).

In this paper, the computational technique is based on the fuzzy numbers defined by Mon et al. (18). Table 2 outlines each membership function (the scale of the fuzzy number) defined by three parameters of the symmetric triangular fuzzy number: The left point, middle point, and right point of the range over which the function is defined.

| Fuzzy Number | Linguistic Scales | Scale of Fuzzy Number |

|---|---|---|

| 1 | Equally important | 1, 1, 1 |

| 2 | Intermediate value between1 and 3 | 1, 2, 3 |

| 3 | Moderate important | 2, 3, 4 |

| 4 | Intermediate value between3 and 5 | 3, 4, 5 |

| 5 | Essentially important | 4, 5, 6 |

| 6 | Intermediate value between 5 and 7 | 5, 6, 7 |

| 7 | Very vital important | 6, 7, 8 |

| 8 | Intermediate value between 7 and 9 | 7, 8, 9 |

| 9 | Extreme vital important | 9, 9, 9 |

Membership Function of the Linguistic Scale

3.3.3. Fuzzy Analytic Hierarchy Process

The procedure for determining the weights of evaluation criteria by FAHP can be summarized as follows:

Step 1: Form pairwise comparison matrices between the identified and finalized indicators (9 provided indicators) and compare them two by two, weighted by fuzzy numbers.

Step 2: Use the geometric mean technique to define the fuzzy geometric mean and fuzzy weights of each criterion, as proposed by Buckley (15).

3.4. Ethics Approval and Consent to Participate

This study received approval from the Ethics Committee of Islamic Azad University Mobarakeh Branch (Reference no.: 19021254971004). The methods were conducted in accordance with relevant guidelines and regulations. Written informed consent was obtained from all participants before participating in the study. Participants were informed about the study's purpose, and participation was voluntary, with the option to withdraw at any time without providing an explanation.

4. Results

4.1. Demographic Characteristics (Expert Panel Members)

In the present study, a total of 20 participants were included (18 males and 2 females) (Table 3).

| Variables | Frequency (%) |

|---|---|

| Age | |

| 30 - 40 | 5 (25) |

| 40 - 50 | 13 (65) |

| > 50 | 2 (10) |

| Gender | |

| Male | 18 (90) |

| Female | 2 (10) |

| Education | |

| Bachelor’s degree | 7 (35) |

| Master’s degree | 8 (40) |

| Ph.D. degree | 5 (25) |

Demographic Characteristics of Participants

4.2. Scoping Review Results

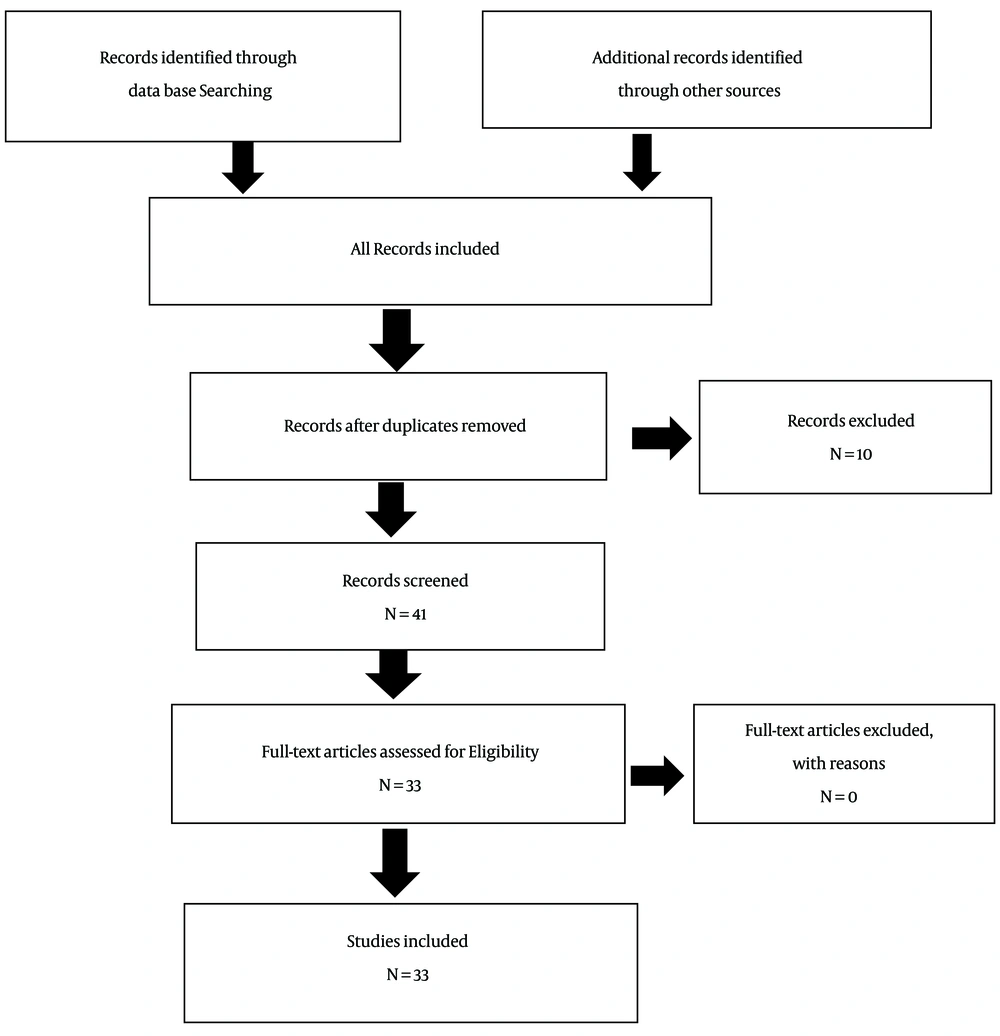

A total of 43 articles were retrieved through the search strategy, of which 41 articles were excluded, and 2 were grey literature (e.g., books and dissertations). After removing duplicates (n = 10), 33 articles met the inclusion criteria and were retained to examine the indicators and dimensions of the model (Figure 1).

4.3. Fuzzy Delphi Results

After examining the opinions of experts (using the fuzzy Delphi process), 12 indicators to measure the concept of customer satisfaction were identified, including premium, insurance coverage ceiling, timely payment of medical expenses of the insured, providing online services, respectful treatment, reasonableness of required documents, waiting period, notification, complaint handling, franchise, and discrimination (Tables 4 and 5).

| Row | Indicator | Indicator Code | Fuzzy Score | Definite Score | Situation | ||

|---|---|---|---|---|---|---|---|

| 1 | Appropriateness of the per capita membership fee rate in the supplementary health insurance contract | B1 | 1.411 | 1.125 | 0.768 | 1.101 | Confirmed |

| 2 | Order in conducting insurance affairs | B2 | 1.089 | 0.750 | 0.411 | 0.750 | Confirmed |

| 3 | Appropriate information on how to provide complementary health insurance services | B3 | 1.143 | 0.839 | 0.482 | 0.821 | Confirmed |

| 4 | Reasonability of documents required to pay for medical expenses | B4 | 1.375 | 1.232 | 0.875 | 1.161 | Confirmed |

| 5 | Providing online services and medical centers of the contracting party | B5 | 1.393 | 1.286 | 0.911 | 1.190 | Confirmed |

| 6 | Lack of time to pay for medical expenses | B6 | 1.071 | 0.732 | 0.393 | 0.732 | Confirm |

| 7 | Timely processing of complaints from the insured | B7 | 1.393 | 1.321 | 0.964 | 1.226 | Confirmed |

| 8 | High ceilings and coverage of obligations | B8 | 1.214 | 0.929 | 0.571 | 0.905 | Confirmed |

| 9 | Consistency in the quality of service delivery | B9 | 1.143 | 0.821 | 0.500 | 0.821 | Confirmed |

The Opinions of Experts

| Row | Indicator | Importance | ||||

|---|---|---|---|---|---|---|

| Very Important | Important | Moderately Important | Unimportant | Very Unimportant | ||

| 1 | Appropriateness of the per capita membership fee rate in the supplementary health insurance contract | 4 | 15 | 1 | 0 | 0 |

| 2 | Order in conducting insurance affairs | 1 | 4 | 12 | 2 | 1 |

| 3 | Appropriate information on how to provide complementary health insurance services | 3 | 3 | 12 | 2 | 0 |

| 4 | Reasonability of documents required to pay for medical expenses | 12 | 5 | 3 | 0 | 0 |

| 5 | Providing online services and medical centers of the contracting party | 13 | 5 | 2 | 0 | 0 |

| 6 | Lack of time to pay for medical expenses | 1 | 3 | 13 | 2 | 1 |

| 7 | Timely processing of complaints from the insured | 16 | 2 | 2 | 0 | 0 |

| 8 | High ceilings and coverage of obligations | 4 | 7 | 6 | 3 | 0 |

| 9 | Consistency in the quality of service delivery | 2 | 10 | 2 | 4 | 2 |

The Opinions of Experts

4.4. Prioritization of Dimensions and Indicators of Customer Satisfaction (Fuzzy AHP)

After forming the matrix of pairwise comparisons of indicators and collecting experts' responses to the pairwise comparisons, the inconsistency rate (0.07) of the table was calculated, indicating that the stability and reliability of the paired comparisons were acceptable. Then, using the geometric mean method of the answers it was integrated in the form of paired comparisons, and the weights of paired comparisons were calculated using the geometric mean method. Premium with a final weight (0.190), insurance coverage ceiling (0.187), timely payment of medical expenses of the insured with a final weight (0.144), providing online services (0.139), respectful treatment (0.066), reasonableness of required documents (0.063), waiting period (0.059), notification (0.033), complaint handling (0.039), franchise (0.037), and discrimination (0.022) were prioritized (Tables 6 and 7).

| A1 | A2 | A3 | A4 | A5 | A6 | A7 | A8 | A9 | A10 | A11 | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| L | M | U | L | M | U | L | M | U | L | M | U | L | M | U | L | M | U | L | M | U | L | M | U | L | M | U | L | M | U | L | M | U | |

| A1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 2 | 3 | 1 | 2 | 3 | 1 | 2 | 3 | 3 | 4 | 5 | 3 | 4 | 5 | 4 | 5 | 6 | 3 | 4 | 5 | 2 | 3 | 4 | 7 | 8 | 9 |

| A2 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 2 | 3 | 1 | 2 | 3 | 2 | 3 | 4 | 2 | 3 | 4 | 3 | 4 | 5 | 4 | 5 | 6 | 3 | 4 | 5 | 2 | 3 | 4 | 5 | 6 | 7 |

| A3 | 0 | 1 | 1 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 2 | 3 | 4 | 2 | 3 | 4 | 3 | 4 | 5 | 3 | 4 | 5 | 2 | 3 | 4 | 2 | 3 | 4 | 5 | 6 | 7 |

| A4 | 0 | 1 | 1 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 2 | 3 | 3 | 4 | 5 | 3 | 4 | 5 | 2 | 3 | 4 | 2 | 3 | 4 | 2 | 3 | 4 | 5 | 6 | 7 |

| A5 | 0 | 1 | 0 | 0 | 1 | 0 | 0 | 1 | 0 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 2 | 3 | 1 | 2 | 3 | 2 | 3 | 4 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| A6 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 2 | 3 | 1 | 2 | 3 | 2 | 3 | 4 | 4 | 5 | 6 |

| A7 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 2 | 3 | 1 | 2 | 3 | 2 | 3 | 4 | 3 | 4 | 5 |

| A8 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 1 | 0 | 0 | 1 | 0 | 0 | 1 | 1 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 2 | 3 | 1 | 1 | 1 | 3 | 4 | 5 |

| A9 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 1 | 0 | 1 | 1 | 1 | 0 | 1 | 1 | 0 | 1 | 1 | 0 | 1 | 1 | 1 | 1 | 1 | 2 | 3 | 4 | 2 | 3 | 4 |

| A10 | 0 | 1 | 0 | 0 | 1 | 0 | 0 | 1 | 0 | 0 | 1 | 0 | 1 | 1 | 1 | 0 | 1 | 0 | 0 | 1 | 0 | 1 | 1 | 1 | 0 | 1 | 0 | 1 | 1 | 1 | 1 | 1 | 1 |

| A11 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 1 | 1 | 1 | 1 | 1 | 1 |

Pairwise Comparisons of the Criteria (Inconsistency Rate: 0.07)

| Indicator | Geometric Mean | Fuzzy Weight (W ̃) | Non-fuzzy Weight | Normal Weight | ||||

|---|---|---|---|---|---|---|---|---|

| Premium | 1.945 | 2.724 | 3.411 | 0.119 | 0.174 | 0.330 | 0.200 | 0.190 |

| Insurance coverage ceiling | 1.936 | 2.682 | 3.354 | 0.118 | 0.171 | 0.325 | 0.197 | 0.187 |

| Timely payment | 1.489 | 2.257 | 2.334 | 0.091 | 0.144 | 0.226 | 0.152 | 0.144 |

| Providing online services | 1.398 | 2.17 | 2.273 | 0.085 | 0.139 | 0.220 | 0.146 | 0.139 |

| Respectful treatment | 0.677 | 1.105 | 0.96 | 0.041 | 0.0707 | 0.093 | 0.069 | 0.066 |

| Reasonableness of documents need | 0.634 | 1.047 | 0.974 | 0.038 | 0.067 | 0.094 | 0.067 | 0.063 |

| Waiting period | 0.621 | 0.953 | 0.909 | 0.038 | 0.061 | 0.088 | 0.067 | 0.059 |

| Notification | 0.438 | 0.777 | 0.623 | 0.026 | 0.049 | 0.060 | 0.047 | 0.044 |

| Complaint handling | 0.487 | 0.881 | 0.677 | 0.029 | 0.056 | 0.065 | 0.052 | 0.049 |

| Franchise | 0.413 | 0.643 | 0.497 | 0.025 | 0.041 | 0.048 | 0.039 | 0.037 |

| Discrimination | 0.274 | 0.366 | 0.308 | 0.016 | 0.023 | 0.029 | 0.023 | 0.022 |

| 10.31871119 | 15.61608918 | 16.327472 | ||||||

Fuzzy and Non-fuzzy Weights of Indicators

5. Discussion

In the pursuit of developing and growing a service-oriented business, the utilization of customer satisfaction has become a fundamental concern (19). In this study, after reviewing the literature and conducting interviews with experts, 11 factors were identified and prioritized. The results of this study align with the findings of Nguyen and Nagase in Vietnam, who examined the relationships among various factors in an integrated model, including patient expectations (PE), Total Quality Management (TQM), Perceived Service Quality (PSQ), Patient Satisfaction (PS), and Patient Complaint (PC). They discovered that factors such as PC, PSQ, and PS positively impacted the level of customer satisfaction, reaffirming the significance of these findings (20). Gonçalves et al. conducted a study to explore the influence of inertia and group conformity on loyalty in healthcare. Their research revealed that service quality and price positively influenced patient satisfaction, while inertia was crucial in fostering loyalty, particularly within the healthcare sector (21). Previous studies have also explored the impact of service quality, information, per capita payment, and other factors on customer satisfaction, highlighting the importance of these indicators in assessing the concept of customer satisfaction (19, 22, 23). It appears that the aforementioned factors hold substantial significance in measuring customer satisfaction.

Given that experts identified per capita fees as the primary and most crucial factor in creating customer satisfaction, this conclusion can be attributed to the fledgling nature of supplementary medical insurance in the country. Therefore, it is recommended that researchers and decision-makers in insurance companies assess and investigate these indicators in other societies and industries to better measure customer satisfaction and identify a localized set of indicators for measuring this vital concept in the country. Researchers can implement the philosophy of customer orientation, which stands as a paramount pillar in today's competitive market and business landscape.

This study has several limitations. First, it did not consider the role of moderating variables (in terms of complexity and frequency of variables) and the specificity of the model. Second, the study focused solely on the supplementary medical insurance sector. Finally, due to the COVID-19 pandemic, access to some participants was challenging.