1. Background

Looking at futures studies in various countries, it is evident that the outputs of these projects have directed the future paths of economies, societies, environments, science, and technology, explaining alternative futures using scientific methods (1). Future research systematically examines the long-term prospects in knowledge, technology, economy, environment, and society, aiming to identify emerging technologies and prioritize future critical areas (2, 3). Over the past five decades, future studies have evolved from predicting the future to mapping alternative futures and shaping desirable outcomes, addressing both collective societal dimensions and individual inner levels (4).

Social security refers to the benefits that society provides to individuals and households through public and collective measures. These benefits are designed to ensure a minimum living standard and protect people from risks and challenges that can lead to lower living standards and unmet basic needs (5, 6). The social security system must utilize appropriate tools to cover various generations and ensure sufficient financial resources to meet the promised benefits. Each sector or sub-system within the social security system must operate effectively and efficiently to achieve the system's primary goals (7, 8). Social security expansion can significantly reduce economic inequalities and provide better welfare, particularly during retirement or disability (9).

Recognizing the interdependence of economic growth and social security necessitates stable coordination between macroeconomic policies and social security programs. This coordination ensures that the foundation for increasing production activities, efficiency, and overall economic effectiveness is established as social welfare expands (10). It is important to note that the double-bind dependence of economic growth and social security requires stable coordination between macroeconomic policies and social security programs so that the basis for increasing production activities, efficiency, and economic growth can be provided with the expansion of social welfare (11). Many governments struggle to provide their citizens with retirement income as the global population ages (12).

The country's government has proposed ensuring stability in the future; developing such scenarios with the help of experts during economic sanctions and continuous changes in macro variables can help bridge the gap between current realities and the future of this organization. According to the official statistics of the Organization's Economic and Social Computing Center in 2018, there has been an 8-fold increase in the number of insured individuals, while the number of pensioners has increased 19-fold. This disparity is causing significant challenges for the organization's resources (13). The support ratio of the Social Security organization, reflecting the number of insured individuals compared to pensioners, was 6.77 in 2006 and decreased to 4.67 by the second half of 2018 (14). This means that the existence of new problems in the field of social security services and the lack of possible scenarios in the future can cause serious crises in balancing the country's economy.

Most studies in Iran have been conducted in the fields of occupational medicine, occupational health, industrial health, medicine, occupational health engineering, safety engineering, and epidemiology, with very few studies conducted in the field of social sciences (15).

2. Objectives

This study aimed to identify future scenarios for social security services and select the most appropriate one to address theoretical and practical gaps and increase the effectiveness of these services in responding to social needs. The main research question that guided this study was: What potential scenarios will shape the future of social security services in light of significant changes in macroeconomic variables?

3. Methods

3.1. Study Design and Setting

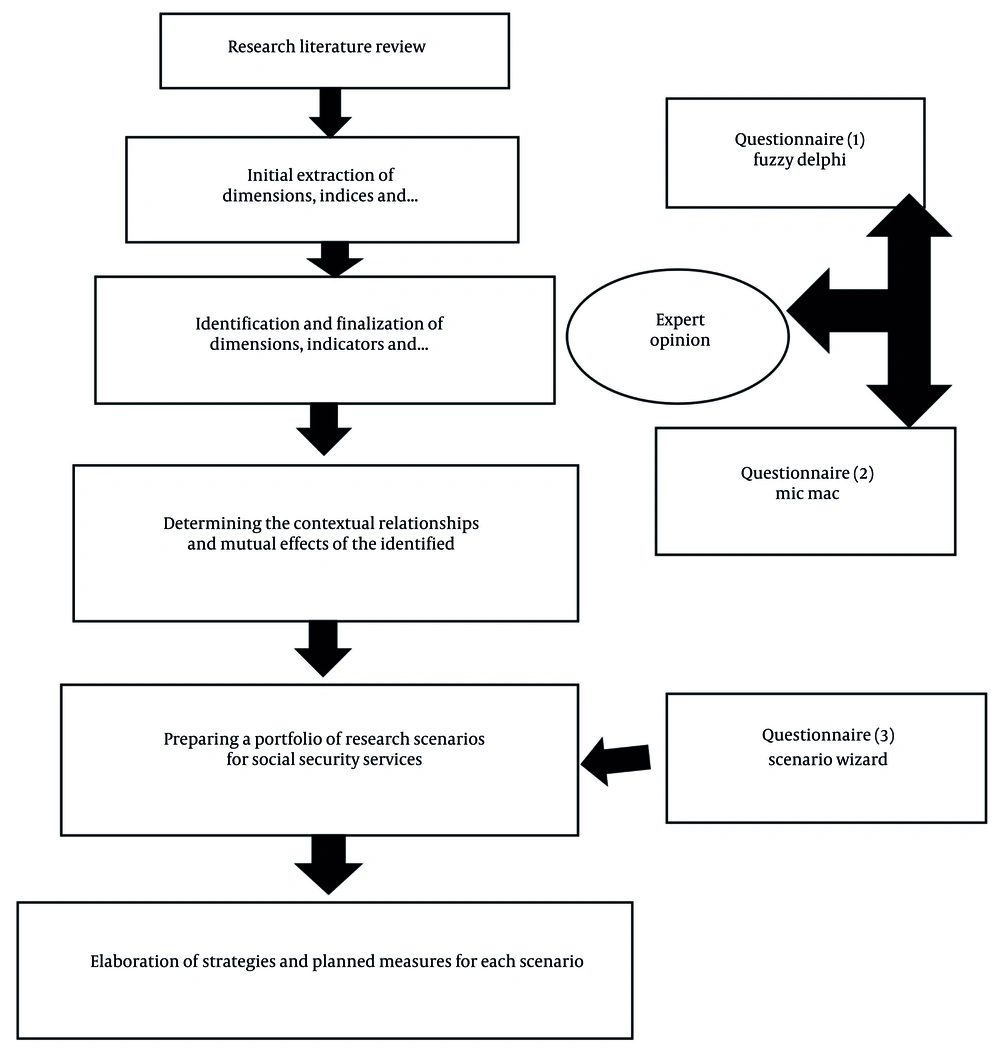

This applied research, using a mixed-method (qualitative-quantitative) approach, was designed and implemented in three stages in 2023 in Khuzestan province to develop possible scenarios for the future of the country's social security services.

3.2. Literature Review of the Subject

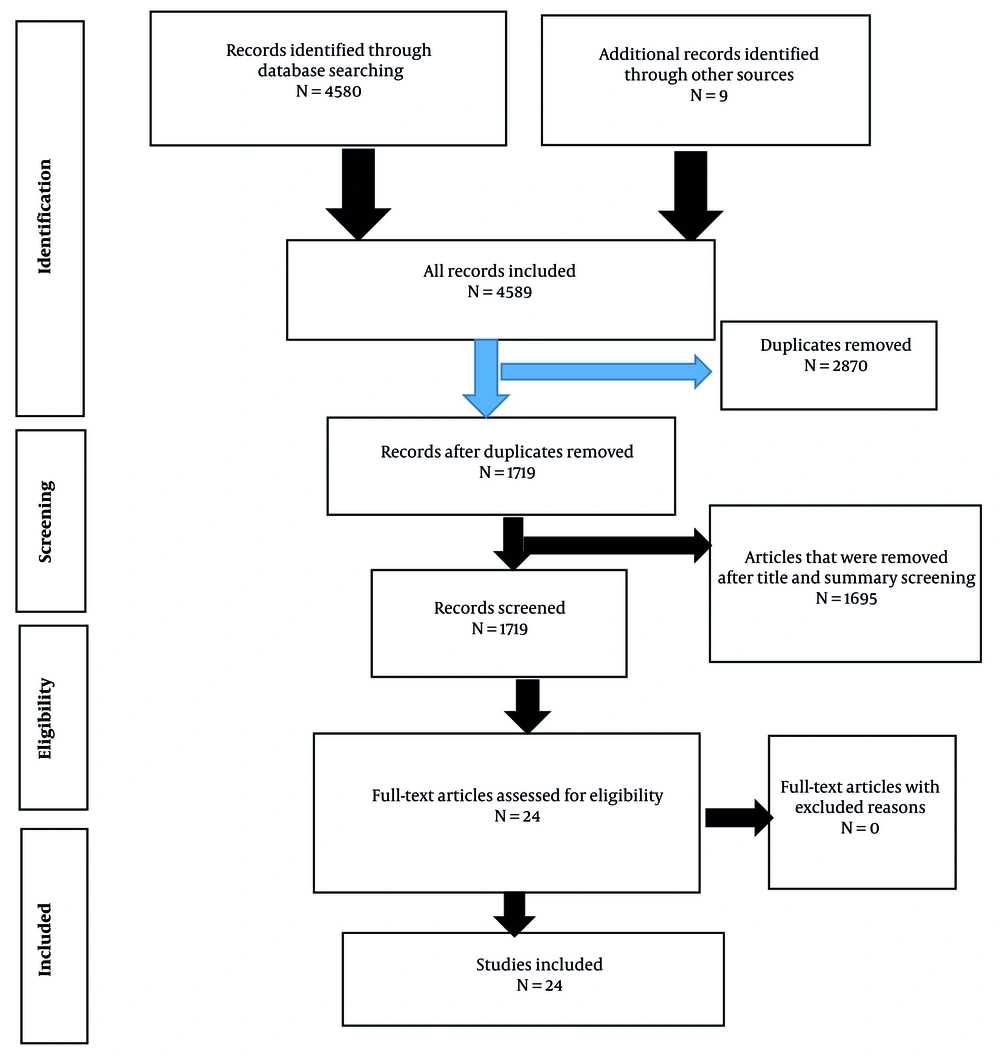

This study employed theoretical models, followed by a review of studies related to future studies in social security services. Electronic databases, including Scopus, Emerald, PubMed, libraries, and reliable scientific sources, were searched for relevant studies. This search aimed to obtain a comprehensive understanding of the components affecting the social security organization (Figure 1).

3.3. Fuzzy Delphi

In this step, after identifying 38 criteria and indicators for developing research scenarios, a decision-making group consisting of relevant experts (university faculty members, managers, and experts of the Social Security Organization) was purposefully formed based on criteria such as knowledge, applicable experience, and interest in participating in this study (Table 1). Subsequently, questionnaires were sent to them to screen and identify indicators related to the main topic of the study. Linguistic variables, as shown in Table 2, were used to express the importance of each indicator.

| Job | Expertise | Degree | No. |

|---|---|---|---|

| 1. Academic staff | Management of healthcare services | Ph.D. | 6 |

| 2. Social security organization of Khuzestan province | Management | Ph.D. | 7 |

| 3. Internal manager of the hospital | Health professional | Ph.D. | 2 |

| 4. Internal manager of the hospital | Management | MSc | 5 |

Sociodemographic Characteristics of Participants

| Trigonometric Fuzzy Numbers | Linguistic Expressions |

|---|---|

| 0, 0, 0.25 | Very little |

| 0, 0.25, 0.5 | Low |

| 0.25, 0.5, 0.75 | Medium |

| 0.5, 0.75, 1 | A lot |

| 0.75, 1, 1 | Very much |

Linguistic Expressions and Fuzzy Delphi Numbers

In this study, triangular fuzzy numbers were utilized. The acquired value of each index was compared with the threshold value, which was set at 0.7 in this study (16). After two rounds of the Delphi process, the mean difference between the two consecutive rounds of fuzzy Delphi was estimated to be less than 0.1, indicating a low consensus among experts and marking the end of the fuzzy Delphi process. Ultimately, four dimensions and 24 relevant indicators (variables) were screened and identified (Table 3). Twenty academic experts, including managers and experts from the Social Security Organization of Khuzestan Province, were recruited. Participants were selected using the purposive sampling method based on relevant knowledge, work experience, and interest in participating in the research (Table 1).

| Indicators and Variables | Fuzzy Average | Definite Average | Definite Average | Difference | ||

|---|---|---|---|---|---|---|

| Inflation | ||||||

| Income from donations and gifts | 0.838 | 0.350 | 0.600 | 0.596 | 0.596 | 0 |

| Domestic and foreign investment | 0.925 | 0.488 | 0.738 | 0.717 | 0.717 | 0 |

| Income of funds, reserves, and property of the organization | 0.950 | 0.588 | 0.838 | 0.792 | 0.792 | 0 |

| Income from crimes and damages | 0.813 | 0.363 | 0.600 | 0.592 | 0.592 | 0 |

| Insurance premium income | 0.975 | 0.575 | 0.825 | 0.792 | 0.792 | 0 |

| Inflationary expectation | 0.925 | 0.488 | 0.737 | 0.717 | 0.717 | 0 |

| Direct medical expenses | 0.913 | 0.413 | 0.633 | 0.663 | 0.663 | 0 |

| Tariff proportionality | 0.950 | 0.513 | 0.763 | 0.742 | 0.742 | 0 |

| Employment | ||||||

| The unemployment rate of the active population | 1 | 0.650 | 0.900 | 0.850 | 0.850 | 0 |

| Birth rate | 0.863 | 0.363 | 0.613 | 0.613 | 0.613 | 0 |

| Death rate | 0.800 | 0.300 | 0.550 | 0.550 | 0.550 | 0 |

| Retirement age | 0.863 | 0.363 | 0.613 | 0.613 | 0.613 | 0 |

| Disability rate | 0.863 | 0.363 | 0.613 | 0.613 | 0.613 | 0 |

| Dropout rate | 0.875 | 0.388 | 0.638 | 0.633 | 0.633 | 0 |

| Marriage rate | 0.875 | 0.388 | 0.638 | 0.633 | 0.633 | 0 |

| Takaful rate | 0.875 | 0.388 | 0.638 | 0.633 | 0.633 | 0 |

| Liquidity | ||||||

| Pension proportionality | 0.913 | 0.413 | 0.663 | 0.663 | 0.663 | 0 |

| Collection of government claims | 0.950 | 0.513 | 0.763 | 0.742 | 0.742 | 0 |

| Sustainability of funds resources and expenses | 0.800 | 0.300 | 0.550 | 0.550 | 0.550 | 0 |

| Wage rate and pension | 0.950 | 0.513 | 0.763 | 0.742 | 0.742 | 0 |

| Economic growth | ||||||

| Exchange rate | 0.925 | 0.488 | 0.738 | 0.717 | 0.717 | 0 |

| Active population rate | 0.950 | 0.513 | 0.763 | 0.742 | 0.742 | 0 |

| Interest rate | 0.925 | 0.488 | 0.738 | 0.717 | 0.717 | 0 |

| Life expectancy | 0.863 | 0.363 | 0.613 | 0.613 | 0.613 | 0 |

The Results of the Second Round of Fuzzy Delphi

3.4. MicMac Analysis

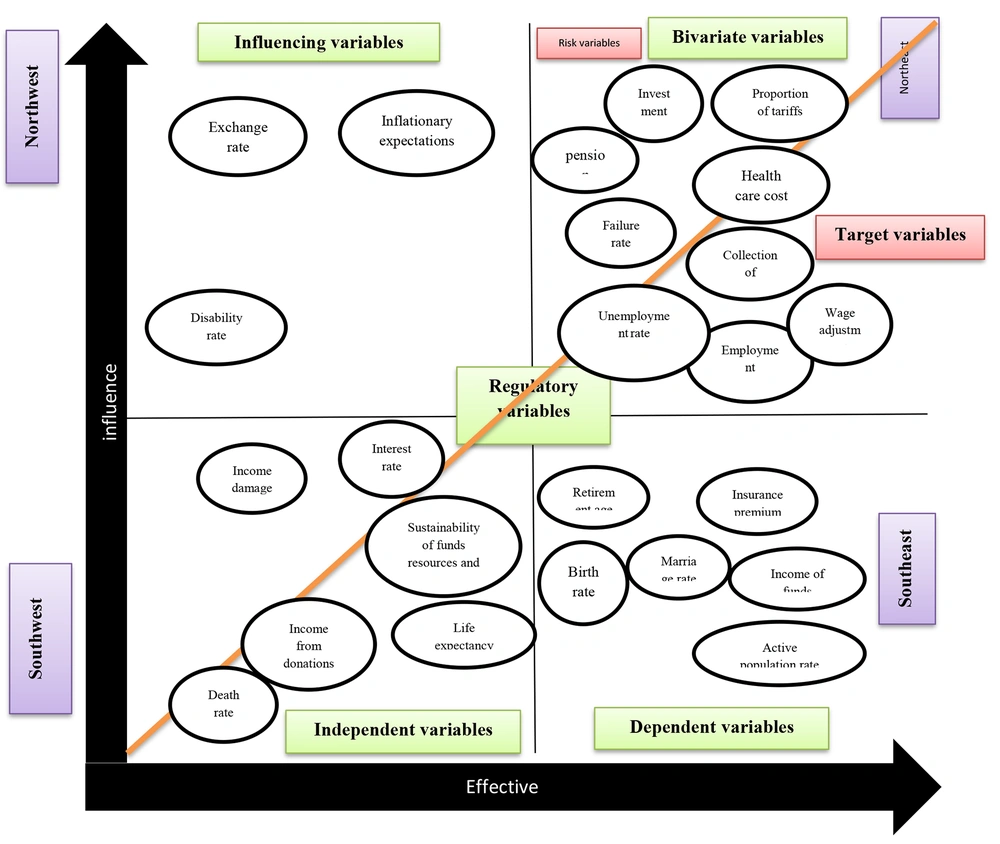

In our study, the interaction questionnaire was initially designed using MicMac analysis, a subset of interpretive structural modeling (ISM) techniques, to measure the interaction of indicators (in terms of influence and effectiveness) on each other (Table 3). Subsequently, experts evaluated the questionnaire by weighting the interactions through pairwise comparisons and assessing the correlation of variables with numbers between 0 and 3 (Figure 2).

Next, the questionnaires were averaged and entered into the MicMac software as an Excel file. Subsequently, different possible situations were considered for each key factor (Table 4).

| Variables | Impact Rate | Effective Ness Rate |

|---|---|---|

| Income from donations and gifts | 37 | 37 |

| Domestic and foreign investment | 32 | 38 |

| Income of funds, reserves, and property of the organization | 29 | 42 |

| Income from crimes and damages | 36 | 45 |

| Insurance premium income | 38 | 40 |

| Inflationary expectation | 34 | 33 |

| Direct medical expenses | 34 | 38 |

| Tariff proportionality | 45 | 34 |

| The unemployment rate of the active population | 45 | 33 |

| Birth rate | 45 | 28 |

| Death rate | 41 | 34 |

| Retirement age | 41 | 39 |

| Disability rate | 35 | 35 |

| Dropout rate | 34 | 34 |

| Marriage rate | 31 | 32 |

| Takaful rate | 33 | 33 |

| Pension proportionality | 30 | 25 |

| Collection of government claims | 28 | 28 |

| Sustainability of funds resources and expenses | 25 | 28 |

| Wage rate and pension | 25 | 27 |

| Exchange rate | 25 | 26 |

| Active population rate | 26 | 32 |

| Interest rate | 30 | 34 |

| Life expectancy | 30 | 33 |

| Total | 550 | 550 |

The Amount of Direct Effects of the Variables

3.5. Scenario Wizard

At this stage, the questionnaires were averaged and entered into the MicMac software as an Excel file. Next, different possible situations were considered for each key factor, and mutual effects were designed as a questionnaire. Finally, the possible situations of the driving forces for social security services were determined (Table 5). The questionnaire was tested and analyzed, and potential scenarios were extracted using the Scenario Wizard software (Table 6). Experts confirmed the content validity of the Delphi Questionnaire. The value of Cronbach's alpha was 0.75, indicating the questionnaire's good reliability (Figure 3).

| Key Factors and Nick Names | Subcomponents |

|---|---|

| Collecting debts | |

| C | |

| C1 | Increasing the collection of social security claims from the government through debt settlement and etc. |

| C2 | Ignoring the collection of social security claims from the government |

| Domestic and foreign investment | |

| I | |

| I1 | Increasing the amount of domestic and foreign investment |

| I2 | Lack of belief and attention to the officials in the importance of investment |

| Adjusting wages to inflation | |

| W | |

| W1 | Adaptation |

| W2 | Relative proportionality |

| W3 | Ignoring proportionality of salary and pension |

| Adjusting tariffs to inflation | |

| T | |

| T1 | Disproportionation (reduction of the tariff rate compared to the inflation rate) |

| T2 | Proportion of tariff rate with inflation rate |

| Health care cost | |

| H | |

| H1 | Reducing the growth rate of direct medical expenses |

| H2 | growth rate agreement |

| H3 | Increase in direct medical expenses |

| Failure rate | |

| F | |

| F1 | Reducing the rate of disability by increasing safety and security in the work environment by compiling and monitoring, implementing and following instructions |

| F2 | Increasing the rate of disability by adopting a policy of ignoring or indifference to safety and security in the workplace |

| Pension proportionality | |

| P | |

| P1 | Disproportionality (tariff increase rate being lower than inflation) |

| P2 | Proportion (equal to the rate of tariffs with inflation) |

| Dependency burden | |

| D | |

| D1 | Reducing the overhead rate (burden) |

| D2 | Stopping the burdensome service process (burden) |

| D3 | Increase in overhead rate (burden) |

| Unemployment | |

| U | |

| U1 | Reducing the unemployment rate |

| U2 | No change in growth rate |

| U3 | Increase in unemployment rate |

Probable Situations of Driving Factors for Social Security Services

| Subcomponents Scenario | Collecting Debts | Domestic and Foreign Investment | Adjusting Wages to Inflation | Adjusting Tariffs to Inflation | Health Care Cost | Failure Rate | Dependency Burden | Pension Proportionality | Unemployment Rate |

|---|---|---|---|---|---|---|---|---|---|

| Scenario (1) | Increasing the collection of government claims | Increasing the amount of domestic and foreign investment | Inadequacy of salaries and wages | Tariffs not proportional to inflation | Stopping the growth rate of medical expenses | Increased rate of failure | Reducing the rate of burden | Non-adjustment of pension with inflation | Maintain the status quo |

| Scenario (2) | Increasing the collection of government claims | Reduction of domestic and foreign investment | Relative proportionality of salaries and wages | Adjusting tariffs to inflation | Increase in the growth rate of medical expenses | Reduce the rate of failure | Reducing the rate of burden | Non-adjustment of pension with inflation | Maintain the status quo |

| Scenario (3) | Reducing the collection of social security claims by officials | Reduction of domestic and foreign investment | Relative proportionality of salaries and wages | Tariffs not proportional to inflation | Reducing the growth rate of medical expenses | Increased rate of failure | Stop increasing the takaful rate | Non-adjustment of pension with inflation | Increase in the growth rate of unemployment |

Possible Status of Strong Scenarios Extracted from the Scenario Wizard Software

4. Results

4.1. Sociodemographic Characteristics of Participants

The sociodemographic characteristics of the panel of experts are represented in Table 1.

4.2. Fuzzy Delphi Results

After examining the opinions of experts using the fuzzy Delphi process, four indicators (inflation, employment, liquidity, and economic growth) and 24 variables were identified (Table 3).

4.3. MicMac Software

Based on primary macroeconomic variables, the Delphi method identified 24 variables in four dimensions as effective factors in the state of social security services. These variables were analyzed using the mutual or structural effects analysis method with MicMac software to extract the main factors affecting the future state of the studied environment (Table 4).

4.3.1. Key Effective Factors in Social Security Services

Among the 24 factors examined in this study, nine factors were extracted according to the purpose of the research. These two-faceted variables, which have high influence and effectiveness, were identified as key variables and drivers of social security services (Table 7).

| Variables | Impact Rating | Effective Ness Rating |

|---|---|---|

| Wage adjustment | 9 | 2 |

| Collection of government claims | 8 | 4 |

| Domestic and foreign investment | 3 | 12 |

| Pension proportionality | 5 | 13 |

| Health care cost | 4 | 5 |

| Adjusting tariffs to inflation | 6 | 6 |

| Failure rate | 7 | 10 |

| The unemployment rate | 11 | 9 |

| Employment | 10 | 11 |

Key Influencing Drivers (Direct and Indirect)

4.3.2. The Results of the Possible Situations of Social Security Service Drivers

After identifying possible situations, the 22 × 22 balanced mutual effects matrix questionnaire was designed and provided to the experts (Table 5).

4.4. Results of Possible Scenarios

Table 6 shows the components of the three strong scenarios. After entering the driving variables into the Scenario Wizard software, 11 possible scenarios were finally obtained, including three strong scenarios with high compatibility and eight weak scenarios. Due to the difficulty and time-consuming nature of the analysis, the weak scenarios were removed from further consideration.

5. Discussion

This study aimed to explore the impact of economic factors on social security services and to identify potential future scenarios. In recent years, demands from social security organizations on the government — one of the key drivers in shaping possible scenarios in this area — have increased significantly. If this trend continues, it may lead to numerous challenges for social security organizations and their services. Solutions such as converting debts into stocks and issuing Islamic treasury documents are viable non-inflationary options to address these issues. A study by Soleimany et al. also highlighted this issue, focusing more on the demands of the health and treatment sector (17).

As one of the most important macroeconomic variables, domestic and foreign investment is influenced by several factors, including monetary, financial, political, and structural variables. In our study, experts recommended several solutions, such as involving insurers in mudaraba investments, planning to reduce interest rates, and coordinating complementary monetary and financial policies to decrease bank profits while increasing productive investments. They also emphasized the need to boost both domestic and foreign investment. A study by Behrouzi et al. highlighted various obstacles and challenges in the investment landscape (18).

Indexing pensions with inflation is mostly done systematically and automatically in different countries. Providing additional benefits such as housing, child, family, and livelihood allowances can significantly increase pensioners' purchasing power. By establishing consumer and housing cooperatives for pensioners and preventing additional financial burdens on the Social Security fund, Social Security organizations can effectively coordinate pension increases with the current inflation rate. Previous studies conducted in Iran have considered this approach; however, they have mainly focused on the advantages, disadvantages, and obstacles of pension indexation (19-21).

The factor of disability as another driver was pointed out by the experts, along with solutions. Some solutions to deal with disability included establishing a connection between job and disability, revising the percentage of disability according to the insured job, amending the unemployment insurance law, and forming an unemployment fund (non-contributory), etc. Adibnia and Montazeri et al. examined this driver and the factors affecting it (22, 23).

In our country, although there have long been attempts to determine the tariffs for healthcare services (diagnostic and therapeutic services) through government supervision and interaction between the supply and demand sides of these services, the tariff-setting mechanism and the tariffs determined have always been criticized by stakeholders in the health system. Tariff rate adjustment, as another driving indicator in the scenarios developed for the future of social security services, can be done by determining the scale of relative value based on resources, reducing the relative value of inappropriate behavior (liability insurance, fines, etc.), setting prices based on agreements between buyers and providers, and pricing based on operating costs.

To effectively reduce unemployment, it is essential to adopt new technologies in the workplace, support knowledge-based companies in producing high-value-added products, develop innovative policies, and assist small, rapidly growing enterprises and home-based businesses. Finally, it should be noted that, despite the country's economic instability and the occurrence of numerous shocks to the social security system, the calculated scenarios should continually be monitored and, if necessary, corrected.

5.1. Limitations and Strengths

Our study has strengths and limitations that deserve mention. The main strength of our study was the combination of techniques used, such as Fuzzy Delphi, MicMac, and writing techniques. Additionally, experts who were knowledgeable in the subject were recruited, ensuring a high level of expertise in the analysis. The economic modifier variables, considered the most critical players in providing social security services, were also thoroughly surveyed.

However, our study also has limitations. The primary limitation was the challenge of identifying and coordinating the experts in compiling drivers and indicators. This coordination was essential for ensuring comprehensive and accurate scenario development.

5.2. Conclusions

Our results revealed 11 possible scenarios, comprising three potential scenarios with high compatibility and eight weak scenarios. Each scenario includes two sets of variables: Income and cost, which are similar. Therefore, adopting appropriate measures and strategies can significantly impact the efficiency and sustainability of social security services. These strategies include offering various types of financial settlement mechanisms with other service organizations, converting debts into shares, engaging insured individuals in investment activities, reforming the patient referral system in affiliated hospitals, developing consumer and housing cooperatives for the insured, creating unemployment funds for individuals with disabilities, organizing more structured labor markets, reducing the relative weight of ineffective treatments, and supporting knowledge-based enterprises. Implementing these strategies can reduce the costs associated with delivering social security services and enhance the net income of the social security organization.