1. Background

Clean beauty is reshaping the cosmeceutical and skincare landscape. In a recent international survey of over 4,500 individuals from Asia, Europe, and the United States (US), 72% of respondents, across all age groups, reported that purchasing healthy or clean personal care and beauty products was important to them (1). The rise of conscious consumerism, along with a shift among shoppers towards products that prioritize health and safety, has fueled demand for “clean” skincare products, with the clean beauty market projected to reach 39 billion USD by 2033 (2, 3). However, the US Food and Drug Administration (FDA) has not defined “clean,” and there is no scientific evidence validating the term (4). As “clean beauty” continues to trend, it has become increasingly important to gain insight into this booming yet ambiguous market (5-7).

The lack of a universal consensus on the definition of “clean” has led to open interpretation within the skincare industry, resulting in many previously accepted ingredients now being labeled as “dirty” or unsuitable for use (8). One major food retailer, Whole Foods, has a list of over 240 ingredients avoided in its clean beauty products, which can be found on its website. Similarly, the Environmental Working Group’s (EWG) “Unacceptable List” includes over 600 pages of compounds they consider problematic (9, 10).

The issues arising from the demonization of certain ingredients by the clean beauty movement and the lack of standardized, scientifically grounded definitions are twofold. First, more consumers are opting for products labeled as “natural,” assuming these are less likely to cause adverse reactions or contain harmful ingredients, due to the industry’s interchangeable use of the terms “clean” and “natural” (11). Although perceived as more benign than their synthetic counterparts, studies have shown that many products advertised as “natural” often contain botanical extracts that can trigger adverse skin reactions (12, 13). Between 1996 and 2016, there was a 2.7-fold increase in allergic contact dermatitis (ACD) related to personal care products, raising further concerns about the impact of the rising popularity of clean or natural products and the implications for physicians treating these conditions (14, 15).

The unwarranted removal of safe compounds is another issue fueled by the clean beauty movement. Although extensive research supports the safety and efficacy of parabens, and the FDA strictly regulates their concentrations in products, “paraben-free” labeling is increasingly common in clean beauty (16). This may stem from the clean beauty industry’s over-interpretation of animal studies, where conclusions drawn from paraben concentrations much higher than those encountered by consumers have led to fears about potential endocrine-disrupting effects (17). The movement’s rejection of certain ingredients has led to their replacement with more allergenic compounds, as seen in the global increase of isothiazolinone contact allergy following its substitution for formaldehyde preservatives (18). Beyond replacing effective preservation systems, the complete removal of ingredients that control harmful microbe growth, simply to align with “clean” trends, presents an additional health risk (19, 20). The ambiguity surrounding what truly constitutes clean products warrants further investigation to determine whether these trends are resulting in products that are ultimately safer and better tolerated by consumers.

2. Objectives

The objective of this study is to determine the prevalence of allergenic ingredients in clean-labeled skincare products.

3. Methods

3.1. Search Protocol and Inclusion Criteria

The “clean skincare” category of [Sephora], the leading online store in the global e-commerce beauty market (21), was queried on February 21, 2024, for the following three product categories: “moisturizers,” “cleansers,” and “sunscreens.” This search yielded a total of 419 products, comprising 197 moisturizers, 131 cleansers, and 91 sunscreens. Duplicate products, non-individual products, items without an ingredient list, and non-cosmetic/non-skincare items were excluded.

3.2. Data Extraction

The ingredient list of each product was manually extracted from its product website and assessed for the presence of the following potentially allergenic compounds: Phenoxyethanol, tocopherol, benzoic acid/benzoates, propylene glycol (PG), alkyl glucosides, ethylhexylglycerin, cetyl alcohol, and a range of documented allergenic fragrance/botanical compounds (including amyl cinnamal, amylcinnamyl alcohol, anisyl alcohol, benzyl alcohol, benzyl cinnamate, benzyl salicylate, cinnamyl alcohol, cinnamaldehyde, citral, citronellol, coumarin, eugenol, farnesol, geraniol, hexyl cinnamaldehyde, hydroxycitronellal, hydroxyisohexyl 3-cyclohexene carboxaldehyde (HICC, also known as Lyral), isoeugenol, lilial, limonene, linalool, methyl 2-octynoate, γ-methylionone, oak moss extract, and tree moss extract). Compounds were selected based on the FDA and American Contact Dermatitis Society (ACDS) potential allergen listings. Additionally, we evaluated the top five best-selling products in the moisturizer, cleanser, and sunscreen categories.

3.3. Data Analysis

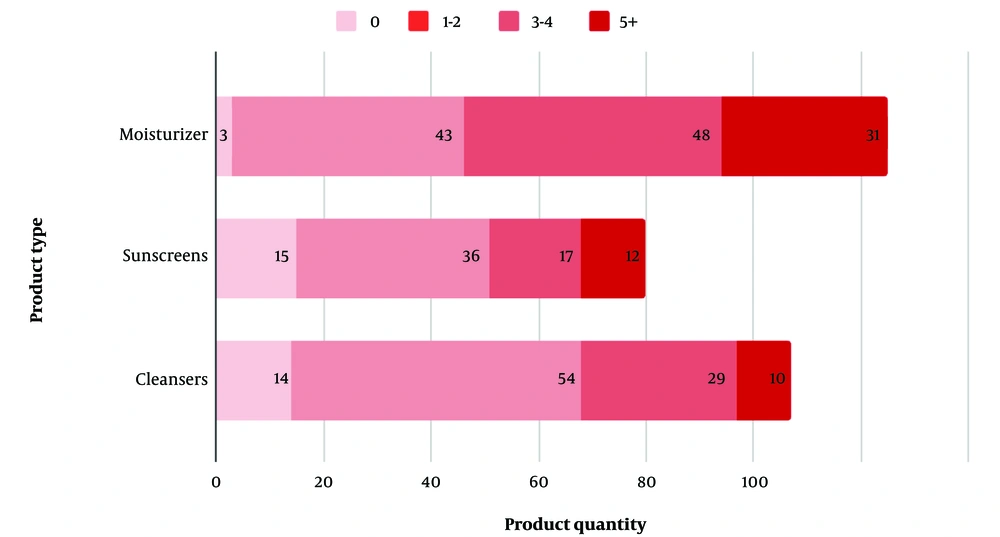

Data analysis was performed using statistical tools in the Python programming language to produce descriptive statistics and linear regression. Figure 1 presents the proportion of each product category containing at least one allergen from the listed compounds in a stacked bar graph, illustrating relative quantities.

4. Results

A total of 313 “clean” skincare products were included in the final analysis, comprising 126 moisturizers, 107 cleansers, and 80 sunscreens (Figure 1).

4.1. Moisturizers

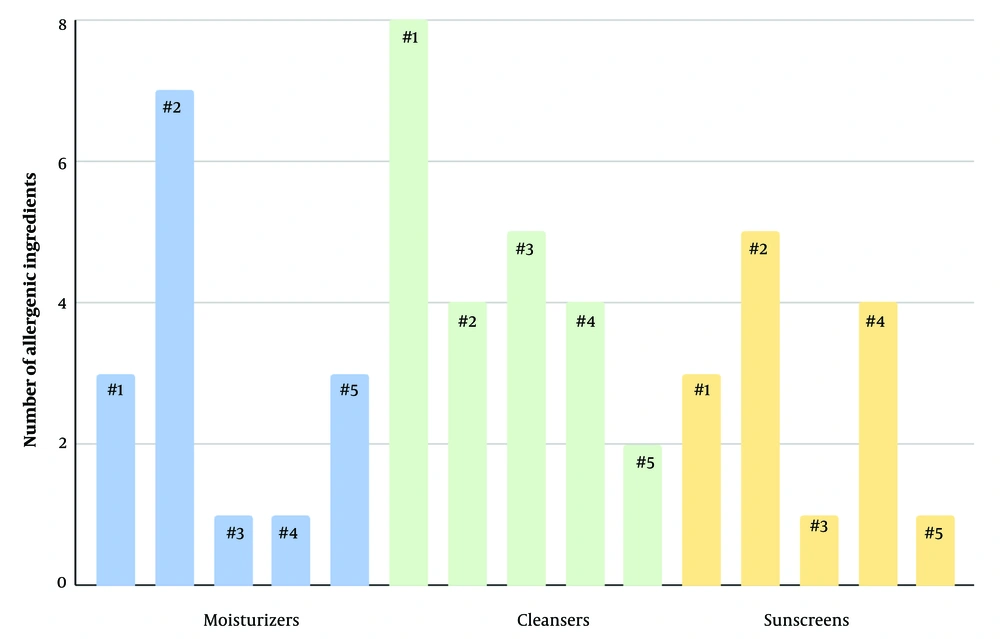

Only three (2.4%) of the analyzed moisturizers were free of any of the listed allergenic compounds (Table 1). The most common allergen found in moisturizers was tocopherol, a class of vitamin E compounds used to extend the shelf life of oil-containing products, present in 93 out of 126 products (73.8%). The preservatives phenoxyethanol and benzoate derivatives were found in 62 (49.2%) and 51 (40.5%) moisturizers, respectively. Ethylhexylglycerin, another preservative and skin conditioner, was detected in 53 (42.1%) of the samples. At least one allergenic fragrance/botanical compound was identified in 38 (30.2%) of the products. Alkyl glucosides, commonly used for their surfactant and emulsifying properties, were found in 29 (23%) of the moisturizers. Cetyl alcohols and PG were present in 18 (14.3%) and 8 (6.3%) of the products, respectively. The respective counts of potential allergens in the top five best-selling moisturizers, in descending order of product sales, are shown in Figure 2.

| Allergenic Compound | Number of Products Containing Allergen (N = 126) | Percentage of Products with Compound (%) |

|---|---|---|

| Fragrance a | 38 | 30.1 |

| Phenoxyethanol | 62 | 49.2 |

| Tocopherol | 93 | 73.8 |

| Benzoic acid/benzoates | 51 | 40.4 |

| Ethylhexylglycerin | 53 | 42.1 |

| Alkyl glucosides | 29 | 23.0 |

| PG | 8 | 0.6 |

| Cetyl alcohol | 18 | 14.3 |

Abbreviation: PG, propylene glycol.

a Includes fragrances listed as allergenic per FDA guidelines: Amyl cinnamal, amylcinnamyl alcohol, anisyl alcohol, benzyl alcohol, benzyl cinnamate, benzyl salicylate, cinnamyl alcohol, cinnamaldehyde, citral, citronellol, coumarin, eugeno, farnesol, geraniol, hexyl cinnamaldehyde, hydroxycitronellal, hydroxyisohexyl 3-cyclohexene carboxaldehyde (HICC, also known as Lyral), isoeugenol, lilial, Limonene, linalool, methyl 2-octynoate, g-Methylionone, oak moss extract, tree moss extract.

4.2. Cleansers

Alkyl glucosides, used for their emulsifying properties in cleansers, were the most prevalent allergen, detected in 50 out of 107 (46.7%) cleanser products. Phenoxyethanol followed closely, found in 43 (40.2%) products. Tocopherol was present in 41 (38.3%) products, showing a significant decrease from its prevalence in the moisturizer category. Benzoate derivatives were found in 30 (28%) of the analyzed products. Ethylhexylglycerin was detected in 23 (21.5%) cleansers, a decrease from its occurrence in moisturizers. Fragrances or botanical compounds were present in 23 (21.5%) products. Cetyl alcohol and PG were found in significantly fewer products, present in 6 (5.6%) and 5 (4.7%) of the cleansers, respectively. Only 14 out of the 107 cleansers analyzed, or 13.1% of the sample, were free from any of the tested allergenic compounds (Table 2). The potential allergens present in each product, arranged according to their sales rankings, are shown in Figure 2.

| Allergenic Compound | Number of Products Containing Allergen (N = 107) | Percentage of Products with Compound (%) |

|---|---|---|

| Fragrance a | 23 | 21.5 |

| Phenoxyethanol | 43 | 40.2 |

| Tocopherol | 41 | 38.3 |

| Benzoic acid/benzoates | 30 | 28.0 |

| Ethylhexylglycerin | 23 | 21.5 |

| Alkyl glucosides | 50 | 46.7 |

| PG | 5 | 4.7 |

| Cetyl alcohol | 6 | 5.6 |

Abbreviation: PG, propylene glycol.

a Includes fragrances listed as allergenic per FDA guidelines: Amyl cinnamal, amylcinnamyl alcohol, anisyl alcohol, benzyl alcohol, benzyl cinnamate, benzyl salicylate, cinnamyl alcohol, cinnamaldehyde, citral, citronellol, coumarin, eugeno, farnesol, geraniol, hexyl cinnamaldehyde, hydroxycitronellal, hydroxyisohexyl 3-cyclohexene carboxaldehyde (HICC, also known as Lyral), isoeugenol, lilial, Limonene, linalool, methyl 2-octynoate, g-Methylionone, oak moss extract, tree moss extract.

4.3. Sunscreens

A total of 80 sunscreen products were evaluated for the presence of allergenic compounds. Tocopherol was the most prevalent compound, detected in 51 (63.8%) of the sunscreen products. Ethylhexylglycerin and phenoxyethanol were present in similar quantities, at 27 (33.8%) and 26 (32.5%) products, respectively. Cetyl alcohol was found in 17 (21.3%) of the products, indicating a significantly higher presence in sunscreens compared to the moisturizer and cleanser categories. Both benzoate derivatives and PG were identified in 12 (15.0%) of the sunscreens, showing a notable but lesser presence. The presence of allergenic fragrances in sunscreens was significantly lower than in moisturizers and cleansers, found in only 11 (13.75%) of the products. Alkyl glucosides were the least prevalent, detected in only 3 (3.8%) of the 80 products analyzed. The sunscreen category also had the highest number of products free from any allergenic compounds, with 15 (18.8%) such products, compared to the moisturizer and cleanser categories (Table 3). The results for the total potential allergen count in the five best-selling sunscreens, in descending order of product sales, are shown in Figure 2.

| Allergenic Compound | Number of Products Containing Allergen (N = 80) | Percentage of Products with Compound (%) |

|---|---|---|

| Fragrance a | 11 | 13.8 |

| Phenoxyethanol | 26 | 32.5 |

| Tocopherol | 51 | 63.8 |

| Benzoic acid/benzoates | 12 | 15.0 |

| Ethylhexylglycerin | 27 | 33.8 |

| Alkyl glucosides | 3 | 3.8 |

| PG | 12 | 15.0 |

| Cetyl alcohol | 17 | 21.3 |

Abbreviation: PG, propylene glycol.

a Includes fragrances listed as allergenic per FDA guidelines: Amyl cinnamal, amylcinnamyl alcohol, anisyl alcohol, benzyl alcohol, benzyl cinnamate, benzyl salicylate, cinnamyl alcohol, cinnamaldehyde, citral, citronellol, coumarin, eugeno, farnesol, geraniol, hexyl cinnamaldehyde, hydroxycitronellal, hydroxyisohexyl 3-cyclohexene carboxaldehyde (HICC, also known as Lyral), isoeugenol, lilial, Limonene, linalool, methyl 2-octynoate, g-Methylionone, oak moss extract, tree moss extract.

5. Discussion

Tocopherol, an antioxidant and preservative, was the most common allergen found in the moisturizer and sunscreen categories. Preservatives phenoxyethanol and benzoate derivatives were also consistently present across all three product categories. These findings align with other studies that also identified tocopherol, phenoxyethanol, and benzoate derivatives as the most common allergens in personal care products (8, 15). Despite their allergenic potential, the ubiquity of these compounds underscores their importance as preservatives to maintain formulation integrity and prevent microbial growth.

Alkyl glucosides, a type of nonionic surfactant, were the most prevalent allergen in the cleanser category. Reports of allergic contact dermatitis (ACD) related to alkyl glucosides have been rising, and in 2017, it was named "Allergen of the Year" by the ACDS (22). Although studies have shown that sodium lauryl sulfate (SLS), another type of surfactant, is safe for use on the skin, there has been a trend among clean beauty companies to ban SLS from their products, raising concerns about its safety. The increase in ACD related to alkyl glucosides may, therefore, be secondary to the replacement of SLS (23, 24).

Among the three product categories, sunscreens had the lowest presence of allergens. This pattern may be explained by the stricter FDA regulations of sunscreen products as nonprescription drugs (25). In contrast, the higher allergen presence in moisturizers and cleansers could reflect the broader range of functional and aesthetic ingredients used in these categories, complicating efforts to eliminate potential allergenic substances (Figure 1).

We quantified the total number of potential allergens in the top five best-selling products in each category: Moisturizers, cleansers, and sunscreens. The results did not reveal any clear trend in allergen count, suggesting that consumer preference for best-selling clean beauty products does not consistently correlate with lower allergen content. This lack of correlation may stem from the ambiguous nature of the term “clean,” which allows companies to formulate products based on their own interpretations, leading to variability in allergen content. Additionally, consumer preferences are influenced by various factors, such as product texture, shelf life, and fragrance, which further contributes to the absence of a specific pattern in allergen counts. The widespread presence of known allergens such as tocopherol, phenoxyethanol, and benzoate derivatives—even in products marketed as clean or hypoallergenic—suggests that the movement’s objectives are not yet fully realized within the industry or by consumers.

There is a complex relationship between marketing narratives and individual health concerns. The allure of clean beauty, with its claims of greater safety and more natural composition, often overlooks the potential presence of allergenic ingredients. The influence of digital platforms has significantly shaped public opinion and increased demand for clean beauty products, fostering a heightened awareness of ingredient safety among consumers. However, this awareness does not always translate into a deeper understanding of dermatological science, as the abundance of information and marketing claims can lead to misinterpretation of data. The gap between public perceptions and the scientific evidence surrounding clean beauty underscores the need for educational efforts to expand consumer knowledge, using dermatological research presented in a manner that is both accurate and accessible.

5.1. Limitations and Future Considerations

This study highlights the potential shortcomings of clean beauty’s promise to deliver safer, less allergenic products, as well as the capacity for consumer exploitation due to a lack of regulations. While this study provides insights into the prevalence of allergenic ingredients in clean-labeled skincare products, certain limitations merit consideration. The exclusive reliance on a single e-commerce platform for data may not fully capture the diversity of the clean beauty market, limiting the generalizability of findings to other retailers and geographic regions and potentially overlooking variations in product formulations and ingredient prevalence. Additionally, the categorization of products as "clean" based on the website’s proprietary criteria may not align with other definitions or standards within the industry, introducing a layer of subjectivity to the analysis. Finally, while the predetermined list of potential allergens was compiled by referencing FDA and ACDS guidelines, it may not encompass the full range of allergenic compounds. The compounds included in this investigation have varying degrees of allergenicity among individuals, meaning that the allergic reactivity of these products may not apply to the general population.