1. Background

In addition to innovation and advanced technology in the modern era, the globalization of products and services has resulted in competitive business environments, requiring data to accurately identify the costs and organizational performance (1). This issue potentially forces health managers and planners to contemplate new approaches to the reduction of waste costs and using the available resources more efficiently (2). Cost analysis is an economical approach to decision-making , as well as an efficient structure to help managers perform better planning in competitive business environments (3).

Activity-based costing (ABC) is a new system with various applications, the use of which is expanding in daily service activities (4). In this costing system, the main assumption is that activities are focused on products or services, while resources are spent on activities (5). The standardization of activities has resulted in the optimal use of human resources and cost control (6). The traditional accounting system has proven inappropriate for the management of hospital resources and accurately determining the costs of services. The ABC approach could provide more accurate costs and information to help managers with cost analysis, decision-making, accurate budgeting, and strategic planning (7). In addition, evaluations have indicated that access to the results of ABC provides the opportunity for process improvement, cost reduction, and accurate costing (8).

Today, ABC techniques have gained popularity in many countries, especially developed countries, such as the United States (9), Italy (10), and Canada (11). Furthermore, developing countries such as Turkey (12) and Taiwan (13) also use this costing method to enter and stabilize the global competitive market. In Iran, the studies by Bahadori et al. (14), Mouseli et al. (15), and Rajabi and Dabiri (16), have proposed various results in different hospital wards in this regard.

Shahid Rajaei Hospital in Qazvin, Iran continues to use the traditional costing system to identify its costs, and due to the shortcomings of the traditional costing system in the accurate identification of support and overhead costs, the ABC model for the operation of the CT-scan unit in this hospital could be appropriate.

2. Objectives

The present study aimed to calculate the costs of the services provided by the CT-scan unit of Shahid Rajaei Hospital in Qazvin using the ABC model and compare the results with the Iranian Ministry of Health tariffs approved in 2016 - 2017.

3. Methods

This descriptive, applied study was conducted at Shahid Rajaei Hospital in Qazvin, Iran. Shahid Rajaei Teaching and Medical Center is a public referral hospital and the only trauma center in the province. On average, 12,500 outpatients and inpatients visit the center each month. Due to the type of the patients referring to the center, the imaging unit is one of the most important and necessary units to provide services to the patients.

In this study, the ABC method was used to estimate the costs of the CT-scan unit. The required data were extracted retrospectively from the health information system (HIS) and management information system. In addition, the data that were not registered in these systems were collected through observations and interviews. The ABC technique was implemented in eight basic steps, as follows:

1) Definition of the activity centers: Each section and unit of the hospital that performed similar activities was identified as an activity center (e.g., laboratory, kitchen, radiology). The CT-scan unit was considered as the main activity center, and the support units were considered as the sub-activity centers.

2) Separation of the activity centers based on operation: The units were classified as operative or patient-centered sections (directly related to the patients), diagnostic sections (e.g., imaging, laboratory), and support or service-oriented sections (indirectly related to the patients).

3) Costing operations based on each activity center: The costs of each activity center in terms of behavior were divided into two general groups, as follows:

3.1. Direct Costs

3.1.1. Workforce Costs

All the costs related to the employed workforce in the CT-scan unit were identified and recorded within 12 months.

3.1.2. Costs of Consumables

The consumables of the CT-scan unit were divided into two groups of specific consumables (medicines and medical supplies) and general consumables (e.g., stationery, food), the costs of which were calculated.

3.2. Indirect Costs

3.2.1. Direct Overhead

The CT-scan unit overhead costs in the hospital included the maintenance costs, depreciation, and energy carriers. The costs of building maintenance and capital assets were calculated based on the financial documents. The depreciation expense was also calculated according to the law of direct taxes, and the energy costs were estimated using the appropriate defined driver.

3.2.2. Indirect Overhead

This category involved the costs shared by the other units. Initially, all the expenses of the financial and support administrative units that were related to the CT-scan unit were identified based on the ABC steps and shared into the main center using the defined driver.

3.3. Identification of the Activities

All the activities of the personnel of the studied unit, along with the average time of each activity, were identified and recorded.

3.4. Identification of the Activity Drivers and Resource Drivers

In order to share the resources of the activity centers with the activities and cost issues (provided services), the drivers were defined, as follows.

3.4.1. Determining the Output (Cost Subject) of the Activity Center

At this stage, the variety and number of all the provided services in the CT-scan unit during the study period were determined.

3.4.2. Relationships Between Resources of Activity Centers and Cost Subject

In this step, the activities that were performed for each service and resources used per each of these activities were determined.

3.4.3. Calculation of the Total Costs

Based on the findings of the previous stages, the activities performed for each service were identified, and the costs of the applied resources for each activity were also calculated. Finally, the costs of the services were calculated, as follows:

Costs of Services = Costs of Workforce + Costs of Consumables + Overhead Costs

Costs of a Service Unit = Costs of a Type of Service/Number of Same Service

The currency exchange was performed using the official exchange rate during March 2016-April 2017 ($ 1 = 31,386 Iranian Rials) (17).

3.5. Statistical Analysis

Data analysis was performed in SPSS version 23, financial software, and Excel software to increase the accuracy and speed of the calculations. To analyze the calculated total costs of the services in the CT-scan unit of the hospital, the variables of the rate of provided services, personnel costs, costs of capital depreciation, costs of consumed materials and supplies, and overhead costs were used. In addition, the nonparametric Wilcoxon test was used to evaluate the mean differences between the costs of the ABC method and approved government tariffs of the health ministry.

4. Results

The imaging unit of the selected hospital included the radiology and CT-scan units. The CT-scan unit is an independent unit providing the required services to an average of 1,081 outpatients and hospitalized patients per month. The number of the patients visiting in the study period was estimated at 12,975 (3,493 outpatients and 9,482 hospitalized patients), who used the services of the unit. Based on the early stages of the ABC, the identified and classified activity centers included nine operational units, 10 diagnosis units, 19 support units, 13 administrative and financial units, and five other units. As the patients of the CT-scan unit were selected as the target population, the operational units and other diagnostic units were excluded from the study.

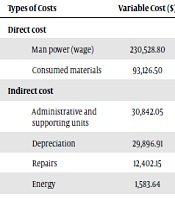

Costing operations were carried out after the separation of the organizational posts in the unit, identification of the activities, and determination of the cost drivers. The total costs of the related unit during 2016 - 2017 was estimated to be 398,380.07 dollars, with 230,528.80 dollars allocated to wages and salaries, 93,126.50 dollars allocated to consumed materials, and 74,724.76 dollars allocated to overhead costs. In the present study, personnel costs and consumed materials were divided into direct cost groups, accounting for 323,655.30 dollars. In addition, 74,724.76 dollars of the total costs were related to the maintenance, energy, depreciation, and overhead costs of the administrative and support units, which were classified as the indirect costs group. Table 1 shows the share of each of the elements of costs to the total costs of the CT-scan unit.

| Sharing Unit | Cost Driver | Sharing Unit | Cost Driver |

|---|---|---|---|

| Financial Department | Number of employees | Waste incinerator | Kg of waste produced |

| Setting Unit | Number of repair requests | Bank | Number of employees |

| Pharmacy | CT output remittances | Informatics | Number of computers |

Example of Defined Cost Driver for Sub-Activity Centers

In the present study, the costs of the consumed materials were divided into two groups of specific consumed materials and general consumed materials. The specific consumed materials included drugs and medically consumed materials (61,865.64 dollars), and generally consumed materials included all the consumed materials used in the unit during the study period (31,260.86 dollars). The cost subject in the total costs was the endpoint, the total costs of which were calculated (Tables 2 and 3).

| Main Group of Activity | Activity Centers | |||||

|---|---|---|---|---|---|---|

| Clinical/operational | Surgery | ICU | Orthopedic | Emergency | Burn | Day care |

| Para clinical/ diagnostic | Laboratory | Imaging | Physiotherapy | |||

| Supporting | installation | Medical equipment | Kitchen | Laundry | Reception | |

| administrative and financial | Administrative | Financial | Management | secretariat | ||

| Other | Bank | Prayer house | ||||

Main Group of Activity and Activity Centers

| Types of Costs | Variable Cost ($) | Share of Total Cost (%) |

|---|---|---|

| Direct cost | ||

| Man power (wage) | 230,528.80 | 57.9 |

| Consumed materials | 93,126.50 | 23.4 |

| Indirect cost | ||

| Administrative and supporting units | 30,842.05 | 7.7 |

| Depreciation | 29,896.91 | 7.5 |

| Repairs | 12,402.15 | 3.1 |

| Energy | 1,583.64 | 0.4 |

| Total cost | 398,380.07 | 100 |

The Share of Each Cost Element from the Total Cost of the CT Scan Unit (USD)

According to the data obtained from the HIS software and health ministry tariffing book, 52 types of services were provided during the study period. After determining the costs, the correlations between the activities and each of the costs were determined, including the wages, consumed materials, and overhead costs. Considering the correlation between the costs and type of services, the share of each service from the total cost of each element of cost was also determined. Finally, the cost of each service (sum of the costs of wages, consumed materials, and overhead costs) was calculated based on the Table 4.

| Cost Object | Number of Delivered Services | Man Power (Wage) | Materials | Overhead | Total Cost | Price of Each Unit |

|---|---|---|---|---|---|---|

| Neck CT scan | 135 | 2,322 | 492 | 395 | 3,209 | 79 |

| Ear CT scan | 38 | 331 | 130 | 95 | 556 | 128 |

| pelvis CT scan | 7 | 53 | 23 | 16 | 93 | 39 |

| Brain CT scan | 14,366 | 73,186 | 46,046 | 30,064 | 149,295 | 107 |

| CT angiography | 173 | 5,934 | 751 | 885 | 7,570 | 219 |

| Lung CT scan | 1,235 | 15,963 | 4,305 | 3,230 | 23,497 | 70 |

| Orbit CT scan | 11 | 115 | 38 | 25 | 177 | 89 |

| Abdomen CT scan | 18 | 315 | 67 | 56 | 438 | 42 |

| Face and sinus CT scan | 583 | 3,523 | 1,967 | 1,442 | 6,932 | 83 |

| Abdomen and pelvis CT scan | 2,196 | 57,056 | 8,921 | 8,968 | 74,944 | 151 |

| Other CT scan | 7,623 | 71,730 | 30,387 | 29,548 | 131,661 | 243 |

Cost Price of CT Scan Services (USD)

The provided services in the CT-scan unit during 2016 included 52 types of services, in which the total number of the CT-scan services was 26,385 during the study period. The costs of each service unit were calculated, and the Kolmogorov-Smirnov test was used as the normality test for the distribution of the total cost data based on the ABC and CT-scan service tariffs. The obtained results indicated that the distribution of these data was not normal, and nonparametric tests were applied to determine the differences between the two methods (P = 0.000).

The nonparametric Wilcoxon test was used to calculate the mean differences between the total costs obtained by the ABC technique and tariffs announced by the Ministry of Health for the 52 provided services. According to the obtained results (Table 4), the total costs of the ABC technique had no significant differences with the tariffs (P ≥ 0.05).

5. Discussion

After performing all the steps required for the implementation of the ABC model, the total costs of the provided services in the CT-scan unit of Shahid Rajaei Teaching Hospital were calculated. The present study was the first in recent years to use ABC in the CT-scan unit of Shahid Rajaei Hospital. According to the findings regarding the total costs of the CT-scan unit in the study period, the direct costs were 81.3% higher than the indirect costs (18.7%). Nisenbaum et al. conducted a similar study in the CT-scan section, and the obtained results indicated that the share of the direct costs was higher than the indirect costs (18). Considering that indirect costs are fixed, their high values could indicate the improper utilization of organizational capacities (16). In contrast, the high ratio of the direct costs to the indirect costs showed the optimal use of the available resources to provide more services (14). In order to exploit the available capacities, the number of available services should increase, and the ratio of the indirect costs should be minimized.

In the present study, the personnel costs and costs of the consumed materials were highest, while the overhead costs were lowest. Our findings regarding the share of each cost element of the total costs are consistent with the studies conducted by Bahadori et al. and Nisenbaum et al. In the mentioned studies, the highest share of costs was related to personnel costs (14, 18). In contrast to the results of the present study, Mouseli et al. calculated the total costs of laboratory services, reporting the costs of the consumed materials (37%) to be higher than the costs of human resources (36.3%) (15).

According to the present study, the costs of the consumed materials were higher than the costs of the consumed materials in the research conducted by Kalhor et al. (2) (4%) and Anzai et al. (8) (14%). This discrepancy could be due to the differences in the research population, costing methods, and accuracy level of the financial information in various studies.

In our study, the overhead costs included the energy carrier costs, building depreciation costs, assets depreciation costs, maintenance costs, and costs that were allocated to the support and administrative units. The share of the overhead costs varies in different studies; Kalhor et al. (2) reported the share of overhead costs to be 37%, while the share of the overhead costs in the study by Anzai et al. (8) was 6.4% .

Depreciation is a significant amount in the category of indirect costs, most of which was attributed to CT-scan depreciation. The reported depreciation value vary in different studies. The number and Rial value of medical equipment, office supplies, and other assets were the cause of the difference in the calculated depreciation cost in different units.

Among the cost elements, the least amount belonged to energy, with the highest cost related to the consumed power due to the frequent use of CT-scan devices. Mouseli et al. also attributed the lowest share to this cost element (15). The defined drivers, number of the devices, area and number of the personnel of the units, and type of the costing method could also affect the total costs.

The comparison of the results of the present study with the approved tariffs during the study period indicated no significant difference between the total price calculated by the ABC method and tariffs of the services (P ≥ 0.05), and the mean tariffs was higher than the mean cost of the services, while the paid tariff was higher than the total price in at least 24 services. In other words, the tariffs paid by insurance organizations were close to the total costs of the CT-scan services during the study period. In this regard, Bayati et al. estimated the costs of the MRI unit to be less than the tariffs approved during their study (6). In addition to the differences in the study populations, this discrepancy could be due to the revisions on the tariffs approved by the Ministry of Health in recent years. The current research showed that the claim of some organizations that tariffs are not realistic at present was untrue, and that new reforms should be applied in their costing and cost control systems.

5.1. Conclusion

According to the results, the costs of the CT-scan services were lower than the tariffs approved by the Ministry of Health. Therefore, the revenue of the CT-scan unit in the study period was higher than the costs, which made the unit profitable. Therefore, it could be predicted that with cost reduction, the unit will reach more profitability, and the outsourcing of the CT-scan services in this center will fail.

5.2. Limitations of the Study

1) Failure to provide accurate information by the authorities due to the inadequate knowledge of the study methodology;

2) Lack of proper infrastructures to accurately record the costs;

3) Lack of proper infrastructures for the accurate calculation and recording of the energy costs;

4) Due to the need to study at the end of the fiscal year, the performed activities during the study period were not recorded, and the probability of error in identifying the activities increased.