1. Context

Today, hospitals have a special place in every country's health system, accounting for the bulk of health resources (1). The financing of hospitals is often through governmental budgets and dedicated revenues such as franchises and payments from insurance organizations (2). A large portion of hospitals’ income is from the payments of insurance organizations, and there are numerous challenges in fully receiving this source of income. A large amount of the requested sum is often not paid by insurance companies as deductions in Iran, which leads to the dissatisfaction of the contracted hospitals (3). Furthermore, the insurance company denies the hospital bill claim. For instance, the surgical ward of a hospital in Tehran has lost 262,818 Rials from its own revenue per patient due to deductions of approximately 6.9% (4).

In studies on deductions, the most important causes of deductions have been reported to be over-request, incorrect documentation, calculation errors, lack of stamp and physician’s signature, inaccuracy in recording costs, and incorrect coding of surgeries (5, 6). Another factor that leads to the high rate of deductions in medical centers is the unawareness of the employees about the importance of documentation and lack of motivation in medical records personnel to investigate and control the cases that are subject to deduction (7, 8).

Given the limited resources in medical centers, increasing the amount of deductions may double the challenges and problems associated with the lack of resources in hospitals (9). On the other hand, hospital deductions lead to the waste of financial resources and the limited financial capacity of hospitals. Meanwhile, deductions impose a significant financial burden on patients by increasing their out-of-pocket costs (10). Given the economic importance of deductions and their negative impact on the quality of services, several studies have addressed the issue.

The study by Imani et al. in Tabriz showed that the extra demand of physicians is the main cause of deductions from hospital records (11). In another study conducted in Qazvin, Rafiei and Sadeghi reported that hoteling services, surgeons’ fees, and drug deductions constituted the highest deduction rate, while physicians’ visits were associated with the lowest deduction rate (9). According to the study by Rezvanjoo et al. in Tabriz, manpower was an important cause of deductions due to factors such as inaccuracy in recording costs, over-demand, and human error (12).

One of the approaches used to reduce the amount of deductions is the proper organization of human resources, in which qualified individuals are selected to control deductions and are hired for a proper position based on their skills (7). Since the role of physicians in creating insurance deductions is undeniable, informing, justifying, and educating physicians regarding the appropriate methods of documentation could be an effective solution to reduce deductions (13). Due to the growing need for healthcare services and increased healthcare costs, the need for high-quality care is also increasing (14). Meanwhile, hospitals are faced with severe financial constraints, which are constantly exacerbated by high deductions. Since Iran is a middle-income country with a limited health care budget, it is critical to focus on the full realization of the revenues of the provided services in order to prevent a budget deficit.

2. Objectives

The present study aimed to determine the amount of deductions in hospitals in Iran and investigate the causes.

3. Study Design

This systematic review and meta-analysis was conducted in 2021 to calculate the pooled value of charge deductions in the public hospitals of Iran in accordance with the principles of the preferred reporting items for systematic reviews and meta-analyses (PRISMA) (15).

4. Data Sources

Data were collected via searching in databases such as Google Scholar, Scopus, PubMed, Web of Science, SID, Magiran, and Irandoc during 2008-December 2021. To identify and retrieve more articles, some authoritative journals were also manually searched. In order to find suitable and sufficient keywords, we initially used the opinion of the supervisors, and the literature search was conducted afterwards. The keywords included “insurance”, “health insurance”, “social security insurance”, “basic insurance”, “medical centers”, “income”, “deduction”, “inpatient records”, “hospital”, “inpatient services”, and “Iran”. The Boolean operators AND, OR, and NOT were also used to combine or restrict the search results. The period of the search protocol was limited to 2008-2021 (Table 1).

| Database | Search Strategy |

|---|---|

| Web of Sciences | (AB= (insurance OR “health insurance” OR “social security insurance” OR “basic insurance” OR “income” OR “deduction”) AND AB= (“inpatient records” OR “hospital” OR “medical centers” OR “inpatient services”) AND AB= (Iran)) OR (TI= (insurance OR “health insurance” OR “social security insurance” OR “basic insurance” OR “income” OR “deduction”) AND TI= (“inpatient records” OR “hospital” OR “medical centers” OR “inpatient services”) AND TI= (Iran)) Refined by: LANGUAGES: ( ENGLISH ) AND LANGUAGES: ( ENGLISH ). Timespan: 2008-2021. Indexes: SCI-EXPANDED, SSCI, A&HCI, ESCI. |

| PubMed | (insurance[Title/Abstract] OR “health insurance”[Title/Abstract] OR “social security insurance”[Title/Abstract] OR “basic insurance”[Title/Abstract] OR “income”[Title/Abstract] OR “deduction”[Title/Abstract]) AND (“inpatient records”[Title/Abstract] OR “hospital”[Title/Abstract] OR “medical centers”[Title/Abstract] OR “inpatient services”[Title/Abstract]) AND (Iran[Title/Abstract]) Filters: in the last 13 years AND "humans"[MeSH Terms] AND English[lang]) |

| Scopus | (TITLE-ABS-KEY(insurance OR “health insurance” OR “social security insurance” OR “basic insurance” OR “income” OR “deduction”) AND TITLE-ABS-KEY(“inpatient records” OR “hospital” OR “medical centers” OR “inpatient services”) AND TITLE-ABS-KEY(Iran)) AND DOCTYPE ( ar OR re ) AND PUBYEAR > 2007 AND ( LIMIT-TO ( LANGUAGE , "English" ) ) |

| Google Scholar | (insurance OR “health insurance” OR “social security insurance” OR “basic insurance” OR “income” OR “deduction”) AND (“inpatient records” OR “hospital” OR “medical centers” OR “inpatient services”) AND “Iran”. Limit: English & Persian[lang] AND ("2008/01/01"[PDat] : "2021/12/01"[PDat] |

| Hand search | “insurance”, “health insurance”, “social security insurance”, “basic insurance”, “medical centers”, “income”, “deduction”, “inpatient records”, “hospital”, “inpatient services” and “Iran”. 2008-2021. Persian and English Lang. |

5. Study Selection

5.1. Inclusion and Exclusion Criteria

The inclusion criteria of the study were studies focused on hospital deductions conducted in the past 13 years in Iran, descriptive and cross-sectional studies with different methods, and studies published in English and Persian. The exclusion criteria were the lack of possibility to calculate the percentage of deductions and articles unavailable in full text.

5.2. Review Process

Articles would be selected if they contained the following keywords in their titles and abstracts: “insurance”, “health insurance”, “social security insurance”, “basic insurance”, “medical centers”, “income”, “deduction”, “inpatient records”, “hospital”, “inpatient services”, and “Iran”. After selection, duplicates were recognized and eliminated from the review process, and the inclusion and exclusion criteria were applied. Finally, the titles of the selected articles were searched in the databases and compiled into a list. The selected studies were screened, and irrelevant articles were eliminated to obtain the most appropriate list. Resource management software (EndNote X6) was used to evaluate and organize the titles and abstracts and identify/remove duplicates.

6. Quality Assessment and Data Extraction

Two experts independently evaluated the quality of the selected publications using the Strengthening the reporting of studies in epidemiology observational (STROBE) tool (16). This checklist consists of 22 items in various segments, including abstract, introduction, method, results, and discussion. The publications that did not report more than 50% of the checklist items were eliminated from the study. Following that, data extraction and quality assessment were performed, and 14 articles were included in the study. Data were extracted on the authors’ name, year of publication, study setting, sample size, percentage and prevalence of deductions, and standard deviation. The causes of deductions were also extracted and classified from the findings of the studies by the two researchers.

7. Statistical Analysis

Due to the different metrics reported for deductions in the reviewed studies, two types of effect sizes were used in the current research. The first effect size was the percentage of deductions, which is obtained by dividing the sum of the monetary value of deductions on hospital claims from insurance organizations. The second effect was the prevalence of deductions, which is obtained by dividing the number of the deducted inpatient records by the total number of the inpatient records. To calculate the pooled effect size, the random-effects meta-analysis was performed in the Stata software version 15 at 95% confidence interval. Possible heterogeneity of the studies was evaluated using the I2 statistic (I2 ≥ 50% indicated heterogeneity). In addition, a forest plot was used to report the results, and publication bias was assessed using a funnel plot.

8. Ethical Approval

The study protocol was approved by the Ethics Committee of Qazvin University of Medical Sciences, Iran (ethics code: IR.QUMS.REC.1397.243).

9. Results

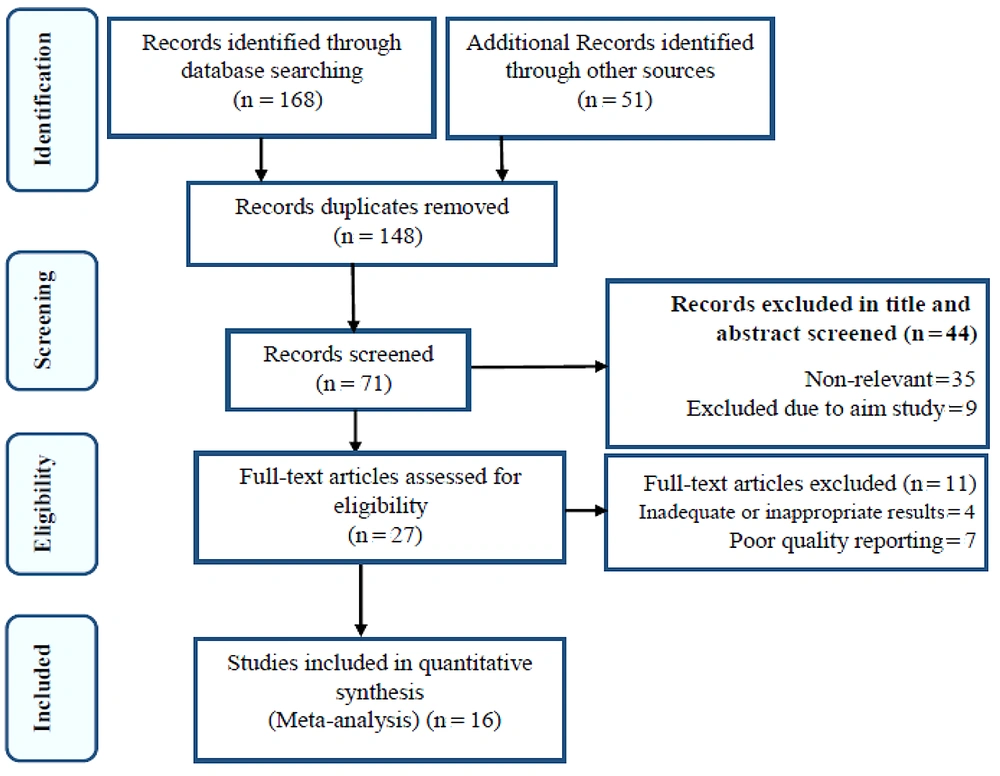

In total, 168 studies were identified in the databases, 51 studies were manually searched in key journals, and 148 publications were eliminated due to duplication. While reviewing the titles and abstracts, 44 articles were excluded from the study process, and 11 studies were also rejected after reviewing the full text. Finally, 16 articles that were completely in line with the research objectives were selected for the review (Figure 1).

Table 2 shows the characteristics of the studies selected for the meta-analysis. Notably, the table is divided into two types of deduction measures, including deduction percentage (DPC) and deduction prevalence (DPV).

| References | Author, Date | N | City | DPC (%) | SD |

|---|---|---|---|---|---|

| (17) | Askari et al. 2011 | 5117 | Yazd | 5.425 | 0.316651 |

| (5) | Mosadeghrad et al. 2018 | 13605 | Tehran | 4.9 | 0.185071 |

| (18) | Mousazadeh et al. 2017 | 356 | Tabriz | 0.705 | 0.443438 |

| (19) | Khanlari et al. 2017 | 1648 | Tabriz | 17.63 | 0.938711 |

| (20) | Zarei et al. 2020 | 400 | Isfahan | 1.1125 | 0.524434 |

| (21) | Sarvestani et al. 2015 | 1706 | Sarvestan | 1.085 | 0.250817 |

| (22) | Khalesi et al. 2011 | 1685 | Tehran | 9.13 | 0.701691 |

| (23) | Rostami and Nasiripour, 2019 | 51699 | Isfahan | 0.552 | 0.032586 |

| (6) | GhaedChukamei et al. 2019 | 22041 | Rasht | 5.46 | 0.153034 |

| Author, date | N | City | DPV (%) | SD | |

| (24) | Mazdaki et al. 2020 | 400 | Tehran | 55.5 | 2.484829 |

| (25) | Madahian et al. 2019 | 692 | Zabol | 67.5 | 1.780494 |

| (18) | Mousazadeh et al. 2017 | 1751 | Tabriz | 20.84 | 0.970641 |

| (26) | Hosseini-Shokouh et al. 2018 | 11992 | Tehran | 29.33 | 0.415746 |

| (27) | Safdari et al. 2013 | 7907 | Kashan | 89.99 | 0.337527 |

| (17) | Askari et al. 2011 | 5117 | Yazd | 29.37 | 0.636706 |

| (28) | Tavakoli et al. 2015 | 800 | Isfahan | 24 | 1.509967 |

Abbreviations: N, sample size; DPC, deduction percentage; DPV, deduction prevalence; SD, standard deviation.

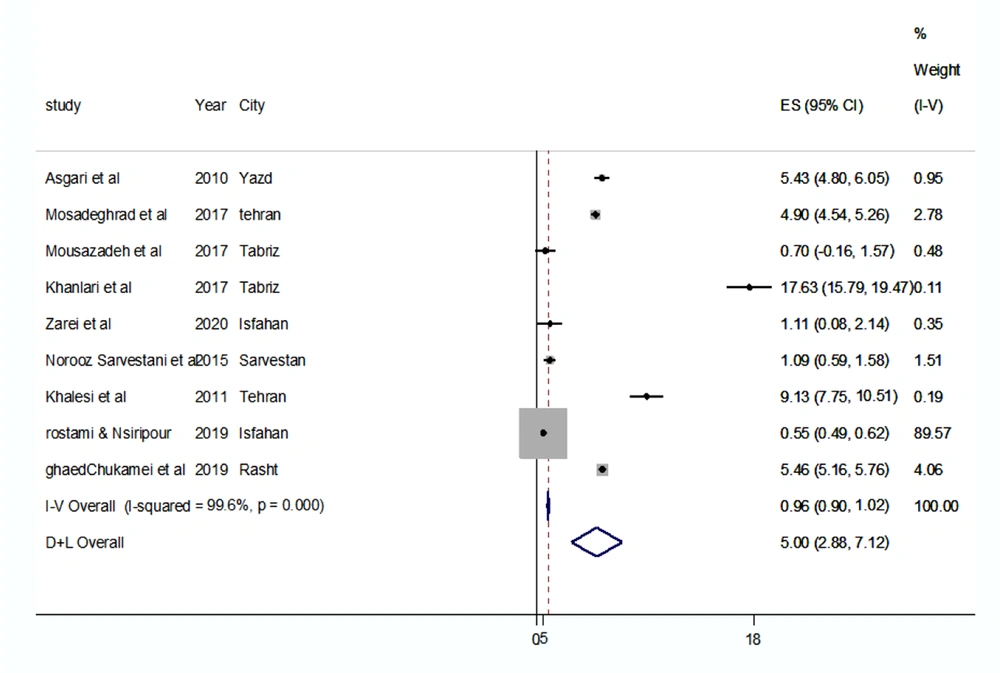

Figure 2 depicts the results of the meta-analysis regarding DPC as fixed effects and random effects. According to the fixed-effects method, the pooled percentage of deductions (PPCD) was 0.96% (95% CI: 0.904 - 1.024), while the PPCD based on the random-effects method was estimated at 5% (95% CI: 2.88 - 7.124). Therefore, the hypothesis was rejected (PPCD = 0; Z = 31.26; P = 0.000). In other words, the PPCD was statistically significant. Evidently, the heterogeneity of the studies was significant as well (chi-square = 2125.07; df = 8; P = 0.000; I-squared [variation in ES attributable to heterogeneity] = 99.6 %). Therefore, the PPCD based on the random-effects method was confirmed as the final result of the analysis.

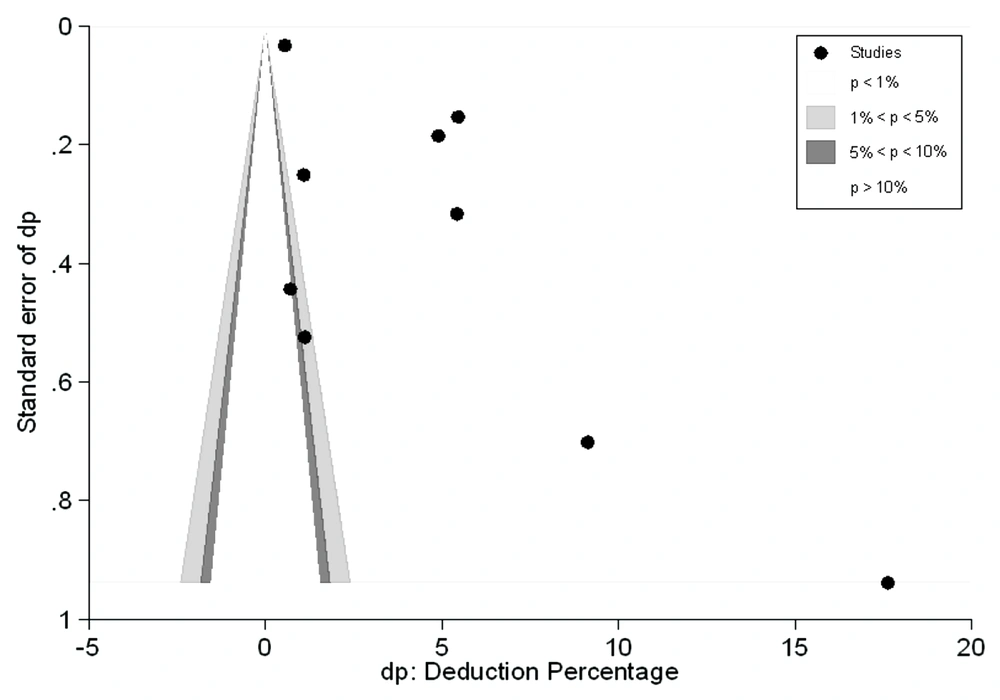

Figure 3 shows the funnel plot of the reviewed studies, depicting asymmetry and the missing studies on the left side of the plot. Notably, such interpretation of asymmetry is incorrect since the effect size in the present was a variable that could not have negative values.

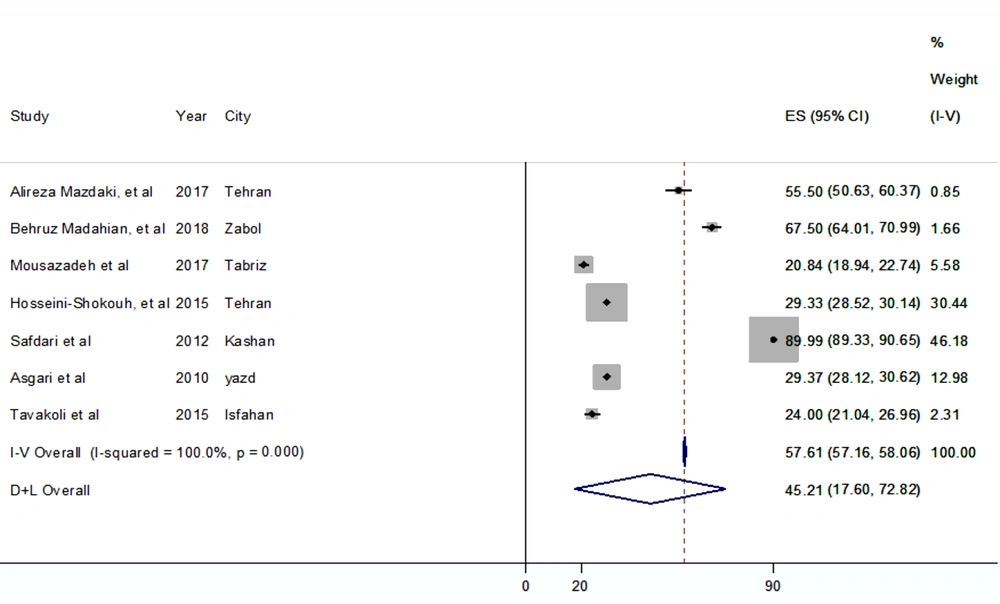

Figure 4 depicts the results of the meta-analysis regarding the prevalence of deductions based on the fixed-effects and random-effects methods. With the fixed-effects method, the pooled prevalence of deductions (PPVD) was 57.61% (95% CI: 57.158 - 58.057), while the random-effects method indicated the PPVD to be 45.21% (95% CI: 17.601 - 72.824). Therefore, the PPVD was considered significant (PPVD = 0; Z = 251.16; P = 0.000). Notably, the heterogeneity of the studies was 100% at this stage (chi-square = 17759.50; df = 6; P = 0.000; I-squared [variation in ES attributable to heterogeneity] = 99.6 %). Due to high heterogeneity, the results of the random-effects method were considered valid.

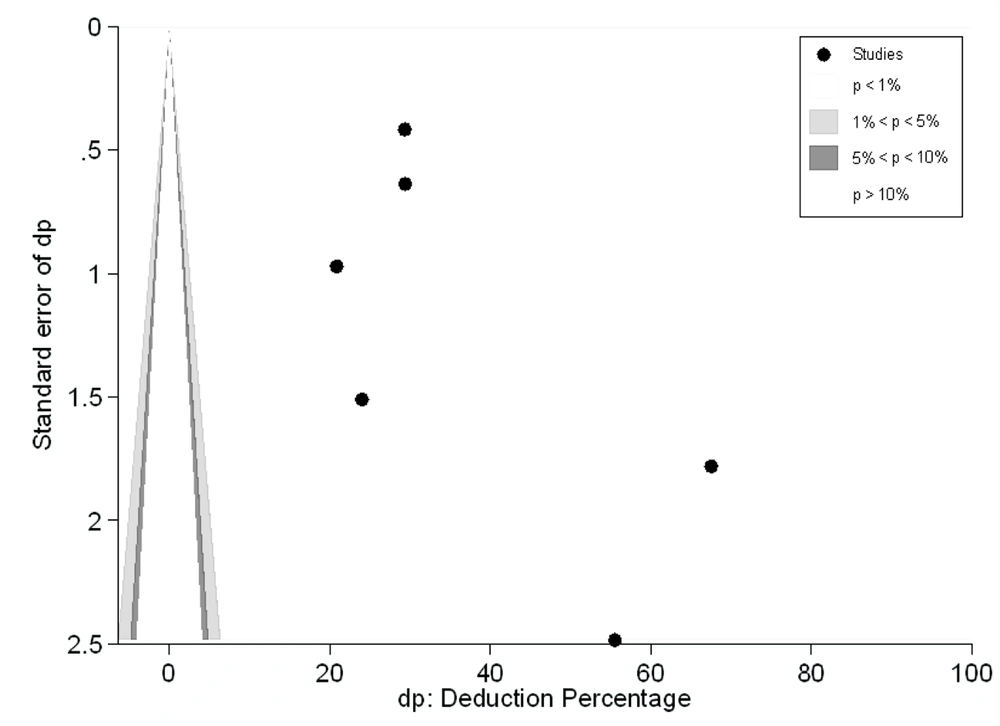

As is shown in Figure 5, the funnel plot was completely asymmetric, and all the studies were on the right side of the diagram. Although it may initially seem like publication bias, the effect size in the present study was a non-negative variable. Therefore, the results of all the analyzed studies are on the right side of the plot.

Table 3 shows the major causes of deductions as reported in the reviewed studies. Accordingly, the most common cause of deductions was documentation problems. The other causes were reported to be defects such as a lack of stamp and the physician’s signature, lack of stamp and the anesthesiologist’s signature, and distorted clinical and paraclinical prescriptions information/content. Problems in the operating room and surgery services were also considered to be the other causes of hospital deductions, as well as diagnostic and laboratory services and the amount of consumed medications.

| Database | Search Strategy |

|---|---|

| Web of Sciences | (AB=(insurance OR “health insurance” OR “social security insurance” OR “basic insurance” OR “income” OR “deduction”) AND AB=(“inpatient records” OR “hospital” OR “medical centers” OR “inpatient services”) AND AB=(Iran)) OR (TI=(insurance OR “health insurance” OR “social security insurance” OR “basic insurance” OR “income” OR “deduction”) AND TI=(“inpatient records” OR “hospital” OR “medical centers” OR “inpatient services”) AND TI=(Iran)) Refined by: LANGUAGES: (ENGLISH ) AND LANGUAGES: (ENGLISH). Timespan: 2008-2021. Indexes: SCI-EXPANDED, SSCI, A&HCI, and ESCI |

| PubMed | (insurance[title/abstract] OR “health insurance”[title/abstract] OR “social security insurance”[title/abstract] OR “basic insurance”[title/abstract] OR “income”[title/abstract] OR “deduction”[title/abstract]) AND (“inpatient records”[title/abstract] OR “hospital”[title/abstract] OR “medical centers”[title/abstract] OR “inpatient services”[title/abstract]) AND (Iran [title/abstract]). Filters: past 13 years AND "humans"[MeSH terms] AND English [lang]) |

| Scopus | (TITLE-ABS-KEY (insurance OR “health insurance” OR “social security insurance” OR “basic insurance” OR “income” OR “deduction”) AND TITLE-ABS-KEY (“inpatient records” OR “hospital” OR “medical centers” OR “inpatient services”) AND TITLE-ABS-KEY (Iran)) AND DOCTYPE (ar OR re) AND PUBYEAR>2007 AND (LIMIT-TO (LANGUAGE , "English")) |

| Google Scholar | (insurance OR “health insurance” OR “social security insurance” OR “basic insurance” OR “income” OR “deduction”) AND (“inpatient records” OR “hospital” OR “medical centers” OR “inpatient services”) AND “Iran”. Limit: English and Persian [lang] AND ("2008/01/01"[PDat]: "2021/12/01" [PDat] |

| Manual Search | “insurance”, “health insurance”, “social security insurance”, “basic insurance”, “medical centers”, “income”, “deduction”, “inpatient records”, “hospital”, “inpatient services”, and “Iran”. Timespan: 2008-2021. Persian and English |

According to the findings, documentation problems were the most common cause of hospital deductions (17.96%), followed by operating room problems and overuse of diagnostic/imaging services. On the other hand, equipment and accessories accounted for the least significance in this regard (2.4%).

10. Discussion

Deduction is a percentage of the charge claimed by the hospital, which is deducted by insurance companies for various reasons. In fact, deductions are a percentage of hospitals’ revenue, which is not paid by insurance companies. Insurance deductions are one of the main challenges between government hospitals and insurance organizations in Iran. Several studies in different regions of Iran have reported different deduction percentages, while no studies have reported the pooled amount of deductions. Therefore, the present study aimed to address the following questions:

(1) How much has been the pooled amount of deductions in Iranian public hospitals during the study period?

(2) What have been the reasons for these deductions?

For this purpose, a systematic review was conducted based on the meta-analysis of the evidence reported in Iran over the past 13 years. As mentioned earlier, the reviewed studies have reported a percentage of deductions by two approaches. Based on the percentage of the deductions, the minimum amount of deductions was 0.55% as reported by Rostami and Nasiripour in Isfahan (23). On the other hand, the largest amount of deductions (17.63%) has been reported by Khanlari et al. in the public hospitals of Tabriz. In addition, the pooled amount of these deductions has been estimated at 5%. On a weighted average, 5% of the requested amount of the hospital is deducted by insurance organizations. Depending on the amount claimed by the hospital, this 5% may differ (19).

In accordance with the method of estimating the prevalence of deductions, the highest prevalence (89.99%) has been reported by Safdari et al. in Kashan (27), while the lowest prevalence (20.84%) has been reported by Mousazadeh et al. in Tabriz (18). According to our analysis, the PPVD has been estimated at 45.21%, indicating that on a weighted average, approximately 45% of inpatient records have been subject to deductions. Notably, these records differ terms of the frequency of deductions, and the reported deduction values also vary in studies. The high value of the heterogeneity index also confirms this finding in the current research. The difference in the value of deductions could be due to the hospital’s specialization, interaction with insurance organizations, culture, manpower punishment, and reward system.

As deductions are a reducing factor for hospital revenues, they could adversely affect the economy of public hospitals. Due to growing production costs of hospitals, short-term deductions could limit hospitals' liquidity, thereby challenging their operations. Reduced revenues due to deductions could also hinder the financial resilience of hospitals and put pressure on the government budget resources in the long run. Insurance deductions are the revenues that the hospital has lost despite providing services to patients and incurring the production costs of these services. Therefore, preventing such a waste of resources should be prioritized by hospital managers. The first step toward this goal is to identify the causes and triggers of deductions in hospitals.

According to the information in Table 2, studies have reported different reasons for hospital deductions, which could be classified into two main categories of technical factors and documentation factors. Technical factors are associated with the overuse of medical supplies, drugs, visits, and the longer hospital stay of patients. This overuse could be caused by the incompliance of the treatment team with approved and standard guidelines. Uncertainty in the treatment process must also be considered in this regard.

Rotter et al. also conducted a systematic review and meta-analysis regarding the use of clinical pathways and the association with the reduction of hospital complications and improved documentation (29). Notably, the educational activities of public hospitals may also be another reason for resource overuse. The results of the current review regarding the documentation of treatment process information revealed problems such as the incorrect coding of surgeries, lack of the physician’s signature, incorrect dates, and the illegibility of documents. Moreover, Aryankhesal et al. performed a systematic review in this regard and reported computational errors, lack of hospital supervision, and file-related problems to be the most important reasons for hospital deductions (30). Notably, multiple documentation problems have simple solutions. To eradicate deductions, interventions should target both the technical and the documentation factors. In addition, training on the documentation process, developing documentation standards, and providing others with the benefits of reduced deduction costs could eventually lead to lower deductions. Another solution is adapting treatment processes to clinical guidelines so as to mitigate resource overuse to some extent. In this regard, Kimiaeimehr et al. concluded that access to information, motivation, attitude change, effective management, creating a systematic vision, providing appropriate feedback, and developing standards for work processes are effective solutions for the implementation of guidelines (31).

One of the limitations of our study was that we could not review all the evidence on deductions. The second limitation was the large heterogeneity between the selected studies, which was partly overcome by using the random-effects model. The third limitation was the non-uniformity of the reported measures for deductions, which was addressed by classifying the values reported by reviewed studies.

10.1. Conclusions

According to the results of this meta-analysis, the pooled percentage and pooled prevalence of deductions reported by the reviewed studies are 5% and 45%, respectively. Furthermore, the reasons for deductions were divided into two groups of causes, which were technical factors and documentation factors. Therefore, it could be inferred that hospital managers should pay special attention to the prevalence of deductions in Iranian public hospitals so that the share of deductions from the bill claimed by the hospital would be manageable even in small amounts. To reduce and prevent deductions, hospital managers should consider the technical factors of deductions and documentation of medical records. Through effective interventions and prioritization, they should target the reviewed deductible stimuli.